Canadian crudes are trading at the widest discounts in many months, against a background of rising heavy sour supply and slower export demand.

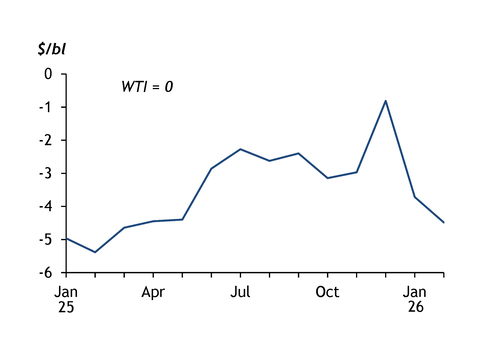

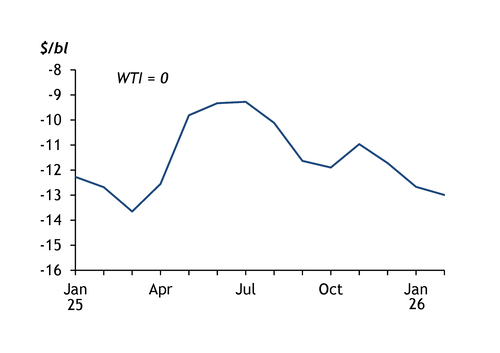

Heavy sour grades WCS and Cold Lake have dropped to their widest discounts in nearly a year to Nymex February calendar-month average (CMA) WTI, at $13/bl in Alberta province and $4.50/bl on a fob Vancouver, British Columbia, basis (see graphs). The implied outright price for WCS in Alberta is under $44/bl. The discount of Texas Gulf coast delivered WCS has averaged more than $5/bl to January CMA WTI, the widest for a trade month since September 2024 deliveries.

This weakness comes against a backdrop of rising supply as Canadian production peaks in the winter months given stable operations in the frozen terrain. Alberta oil sands production averaged 3.55mn b/d over July-October, up by nearly 6pc on the year, data from the Alberta Energy Regulator show. Output hit a record high of 3.67mn b/d in July and is expected to continue to grow in 2026. Argus Consulting forecasts that Canadian crude and condensate production will rise by 1.7pc in 2026 to a record 4.85mn b/d.

The higher supply has also coincided with rising US Gulf of Mexico deepwater production as new projects have come on stream. US Gulf production climbed for a seventh consecutive month to hit 1.98mn b/d in September, up by more than 375,000 b/d year on year, EIA data show.

Increased Opec+ supplies are also keeping Canadian heavy sour crudes under pressure. Production by eight core Opec+ members has increased by 2.3mn b/d since they began unwinding production cuts in April.

At the same time, increased diluent use required to move crude through pipelines during the winter has reduced the refining value of Canadian production. The upcoming US refinery turnaround season in the first quarter will further undermine buying interest.

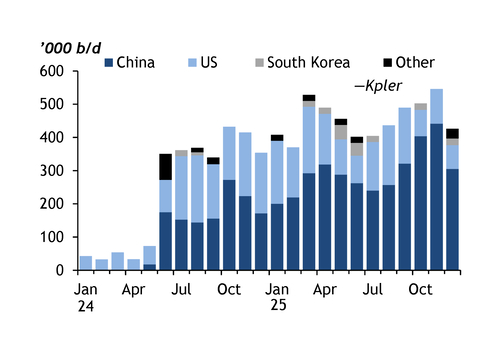

Refinery closures, weak refining margins and efforts to minimise inventories for tax accounting purposes undermined Canadian crude shipments to the US from Vancouver along the 590,000 b/d Trans Mountain Expansion pipeline in the fourth quarter. Shipments fell to around 85,000 b/d from 165,000 b/d in the third quarter, oil analytics firm Kpler data show. US west coast demand is likely to be further undermined by regional refinery closures this year. Phillips 66 halted crude processing at its 139,000 b/d Los Angeles, California, refinery in October 2025 and Valero is likely to close its 145,000 Benicia refinery near San Francisco in April 2026.

Absent Yulong

Chinese imports from Vancouver climbed to a record 442,000 b/d in November as overall supply surged on seasonally strong Canadian production, but the absence of sanctioned Chinese mega-refiner Yulong following the imposition of direct sanctions by the UK and EU over its Russian crude purchases is affecting overall demand. Yulong previously bought three to five heavy Canadian cargoes a month, from an average total of 25. The Shandong refiner's absence has pressured heavy Canadian differentials at Vancouver since October, according to market sources. Demand is also being undermined by competitively priced rival Mideast Gulf crudes and high freight costs.

Tighter heavy sour crude exports from Mexico and Venezuela may help take the pressure of Canadian discounts on the US Gulf coast. Mexican crude exports have averaged just over 350,000 b/d since July, 75,000 b/d less than a year earlier, as more has gone to domestic refineries. Heightened US-Venezuela tensions could also undermine Venezuelan crude shipments to the US.