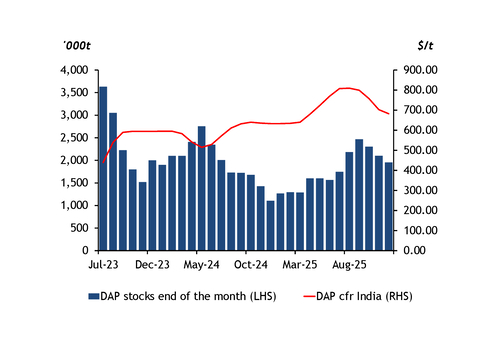

India's domestic fertilizer market is entering it off-season for phosphates, but the country's recent retreat from the global market has caused its DAP stocks to slip.

India's domestic DAP sales fell to around 955,000t in December, from a seasonal peak of 1.40mn t in November, according to provisional data. December sales brought total offtake over 2025 to 9.03mn t, down from an average of 10.3mn t/yr over 2022-24.

But combined DAP and TSP sales were broadly steady year on year, at 9.63mn t in 2025 and 9.69mn t in 2024. TSP did not feature in the Indian market prior to 2024.

Domestic DAP production has held firm, rising to 350,000t last month from an average of 300,000 t/month over January-November, according to provisional data. But DAP production over the whole of 2025 reached only 3.65mn t, compared with an average of 4.31mn t/yr over 2022-24.

Importers pulled back from the market in late 2025 as congestion at ports built up and later arrivals would miss the application window for the season. DAP arrivals fell to 414,000t in December, down by more than half from November imports of 830,000t, according to Argus line-up data. But this brings total DAP imports over 2025 provisionally to 6.43mn t, which is well above the 2022-24 average of 5.91mn t/yr.

India likely ended 2025 with slightly under 2mn t of DAP in stock, down from just over 2.1mn t at the end of November. Bullish imports across the year alongside lower domestic offtake allowed Indian stocks to rebuild from a low of around 1.1 mn t of DAP at the end of 2024.

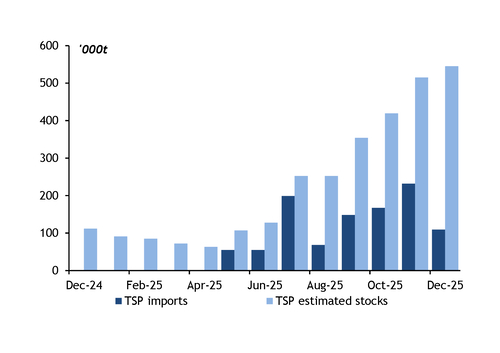

TSP stocks remain high

India likely ended 2025 with around 545,000t of TSP in stock.

Domestic TSP sales probably totalled 601,000t over the whole of 2025, up from 279,000t in 2024.

But TSP imports have far outpaced offtake. Arrivals totalled 1.03mn t over 2025, all from Morocco.