Rising regional competition for imports will continue to support prices, writes Frances Goh

Northeast Asian butane prices are likely to remain at a premium to propane in 2026 as geopolitical tensions continue to alter global LPG trade flows.

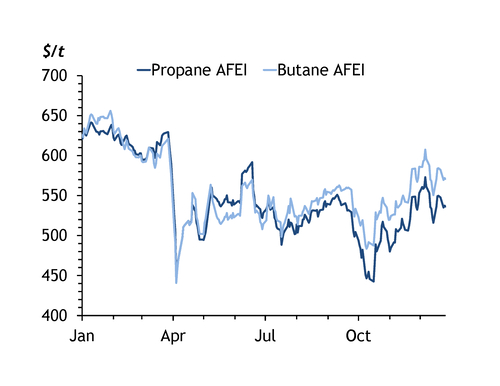

The trade battle between the US and China last year upended established LPG trade flows, with US propane cargoes destined for China being diverted to markets such as Japan and northwest Europe from early April, and mixed propane-butane shipments heading increasingly to south and southeast Asia, while China brought in more propane-butane shipments from the Middle East. The butane Argus Far East Index (AFEI) for northeast Asian deliveries averaged a $34/t premium to its propane equivalent in the fourth quarter of 2025 despite the onset of winter, which typically boosts demand for propane for heating (see graph).

China's propane demand in 2025 came largely from the petrochemical sector, specifically propane dehydrogenation (PDH) plants and crackers. But import growth slowed to about 3pc, compared with 9pc in 2024, because of the effect of tariffs. Demand for butane imports in China meanwhile grew strongly following the opening of five new plants to produce gasoline additive MTBE with a combined capacity of 3.4mn t/yr, which lifted arrivals by nearly 50pc to 7.9mn t.

Securing butane mostly from the Middle East has become more challenging for China because it has to compete with India's growing demand. India's butane imports grew by around 11pc to 11.2mn t last year, Kpler data show. The slowing in China's demand growth for propane from its PDH sector because of negative margins and from crackers as they switch to cheaper naphtha and ethane feedstock means butane could become the driving product in 2026. This is compounded by only three new PDH plants being due to open in China this year. New butane-fed crackers in south China are expected to consume 1.5mn-2.5mn t in 2026.

India's continuing LPG consumption growth last year, in defiance of expectations that it would slow or even contract as the domestic market nears saturation, could also be boosted by the commissioning of the 2,800km Kandla-Gorakhpur LPG pipeline, which will connect India's west coast import terminals and refineries to inland demand centres all the way to the north of the country. A combination of population growth, rising GDP and government incentives to diversify 10pc of LPG imports to the US has lured more Asia-focused traders to the Indian import market, which has historically been dominated by Mideast Gulf producers. US firm P66, as well as supplying two of four monthly US propane-butane cargoes to India this year under the first ever US-India term contract, is also due to supply one cargo a month to Indonesia for the first time. This is a deviation from its traditional northeast Asian markets, where it has been one of the largest butane suppliers.

Crack apart

This shift in US exports left butane buyers in Japan and South Korea short of available cargoes, while Mideast Gulf sellers shipped more propane-butane to China. Japan's butane imports fell by about a fifth to 1.4mn t last year, while South Korea's eased by 2.2pc to just under 2.1mn t, Kpler data show. Yet spot demand in both markets grew in 2025 because of favourable cracking economics for the feedstock, boosting AFEI prices.

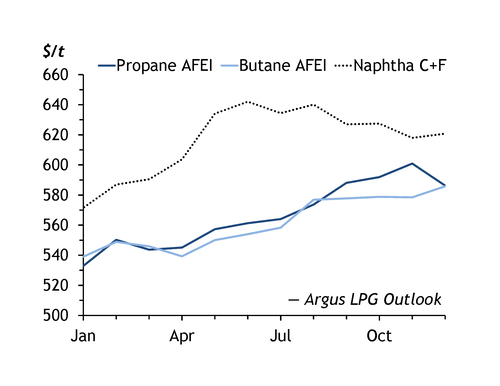

Weakness across the LPG complex kept butane AFEI prices about $38/t below naphtha equivalents from April-December, boosting demand from northeast Asian flexible crackers. Spot offers for 23,000t butane cargoes fluctuated from $40/t discounts to parity to naphtha during the nine months, underscoring butane's strength in an illiquid market. Japanese and South Korean importers are meanwhile likely to secure more butane under term contracts from the US and Australia this year, given reduced spot availability from the US and Middle East, further reducing liquidity.