US naphtha and fuel oil markets moved in opposite directions against a backdrop of higher expected Venezuelan crude supplies to the US following its capture of the country's president, Nicolas Maduro.

Venezuela's role in the products markets is concentrated in high-sulphur fuel oil (HSFO) export and naphtha import trade. US naphtha differentials firmed after energy secretary Chris Wright announced on 7 January that the US is negotiating with Caracas to "indefinitely" take over oil sales by state-owned PdV and supply the diluents and equipment needed to enable a boost in Venezuelan output.

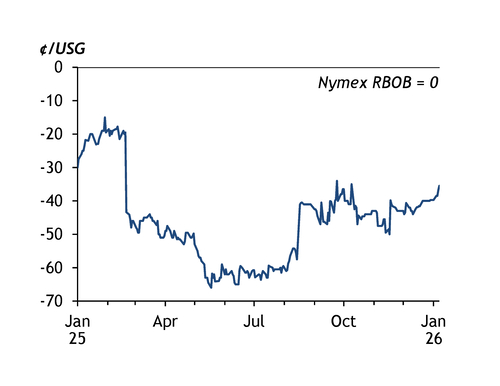

The US has a long history of selling naphtha as a diluent to Venezuela for use in transporting the heavy crude produced there, although sanctions and political tensions have undermined the trade. Heavy-virgin naphtha differentials gained 1.75¢/USG against the Nymex Rbob pricing basis on 7 January, with many sellers withholding offers in anticipation of renewed opportunities to export to Venezuela should there be any changes to the current sanctions regime.

US naphtha exports to Venezuela have lagged its exports to other South American countries such as Brazil and Colombia, as well as to Asia-Pacific, as sanctions have curtailed the trade. But a six-month sanctions waiver from October 2023-April 2024 and a special licence issued to Chevron as a joint-venture partner with PdV have helped reinvigorate some naphtha trading activity.

US Gulf coast naphtha exports to Venezuela fell to just over 40,000 b/d last year from above 55,000 b/d a year earlier, according to oil analytics firm Vortexa. But shipments waned in the second half of last year, as the US flip-flopped over whether to renew Chevron's special licence. No visible US naphtha exports have gone to Venezuela this year.

Venezuela has turned elsewhere in the face of the lower US deliveries. Of its 88,000 b/d of naphtha imports last year, US shipments accounted for 47pc, while Russian receipts made up 41pc, or 36,000 b/d, while China shipped 8,000 b/d. That represents a potential opportunity for US shippers to supply an additional 30,000-40,000 b/d of naphtha to the Latin American country.

When they go high, it stays low

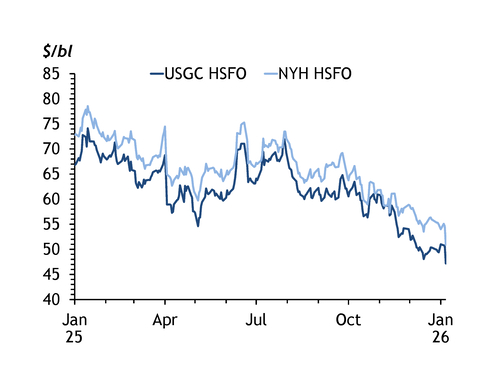

US HSFO differentials recorded the largest day-to-day losses since July 2025 in the US Gulf coast and New York Harbor markets on 7 January, driven by the developments in Venezuela, as prices fell to their lowest since January 2021. HSFO cash prices fell by $3.50/bl to a 60-month low of $47.20/bl on the Gulf coast and by $3.70/bl to a 59-month low of $50.90/bl in New York Harbor. The potential for more Venezuelan heavy sour crude to enter the US had more of an effect on HSFO than low-sulphur fuel oil (LSFO), as heavier grades yield more HSFO when refined and an abundance of heavy crude can lead to HSFO oversupply.

US control of Venezuelan crude supply is expected to increase US HSFO availability as more Venezuelan crude would be refined in the US, rather than sent to Asia, market sources say. In addition to producing more HSFO when refined, an abundance of heavy crude also reduces refinery demand for HSFO as a feedstock, which increases HSFO supply and exerts further pressure on prices.

HSFO has been supported in the Asia-Pacific market by expectations of a reduction in Venezuelan supplies to the region. Venezuela exported about 150,000 b/d of HSFO last year, based on Kpler data, with Singapore and Malaysia taking roughly a third of those flows. But a potential waiver enabling US firms to take Venezuelan product could redirect flows away from Asia. Any redirection of Venezuelan crude to the US away from China could also bolster demand from Chinese refiners for straight-run fuel oil as a refinery feedstock.