Five factors to watch in US and Asian recycling

Following on the heels of Will Collins and Chloe Kinner’s plastic recycling blog (Five things to watch out for in Europe in 2024), Argus’ US and Asian plastic recycling experts outline some of the key issues to watch in their regions in the year to come.

New Jersey recycled content mandates

Extended producer responsibility (EPR) continues to be the fastest-moving legislation in the US for plastics recycling. Several states are considering new EPR schemes, although it’s been quite a few months since the latest EPR bill passed into law in Maryland. But a new law mandating recycled content in plastic packaging in New Jersey may be of particular interest for recyclers this year.

New Jersey on 18 January introduced a 10pc minimum recycled content requirement for rigid plastic containers and 15pc for plastic beverage bottles, becoming the first east coast state, and the third overall after Washington and California, to have such legislation. New Jersey’s is the first mandate to extend beyond beverage containers and waste disposal bags to include rigid plastic containers.

Three of 50 states is a small percentage, although they are home to more than 15pc of the US population, and there is no sign of a nationally binding requirement to use recycled plastic at this stage. But the laws may have an impact outside of their immediate jurisdiction, with companies likely to align their regional or even national supply chains to the strictest legislation to streamline their operations. It will be interesting to see what impact the New Jersey legislation has on recyclate demand – for rPET and recycled polyolefins – during this year.

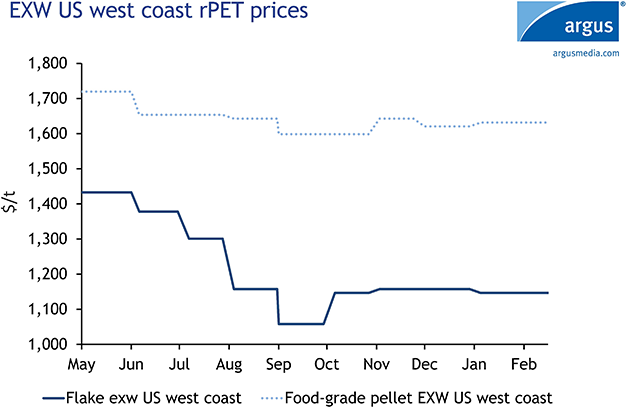

On the west coast, despite California and Washington implementing 15pc rPET mandates for bottles, reclaimers reported that demand was largely unaffected in 2023. rPET recyclers are looking ahead to 2025, when California will increase its rPET mandate obligation to 25pc, in the hope of seeing more of an impact.

Effect of logistics disruption on US trade flows

Imports from southeast Asia provided intense competition for domestic recycled rPET in 2023. Asian rPET has more forgiving margins owing to lower production costs, and has regularly priced 10-15¢/lb below US domestically produced material in recent months. Many US-based reprocessors and flake producers have told Argus that they felt this gulf could risk undermining domestic recycling efforts.

But a rise in shipping costs at the start of this year has the potential to reduce the cost gap between domestic material and long-haul imports. Freight costs for polymers rose sharply in January as a result of ships avoiding the Suez Canal because of security issues and limiting their use of the Panama Canal as a result of drought. Argus’ Freightos derived assessment of the Shanghai to Los Angeles transpacific freight route has more than doubled since the start of this year, to $186.50/t. Rates on routes from Asia to the east coast, which would typically travel through either canal, are likely to be even more affected.

Importers of Asian product told Argus that volumes are too small for shipping cost increases to have a significant impact on the US market balance, and an increase in underlying demand compared with 2023 would offer the most effective support for domestic recyclers. But if shipping disruption continues through 2024, it could reduce the import pressure they are feeling, particularly on the east coast. It might also simply shift the source of the pressure closer to home, as recyclers in Latin America, particularly those with overland access to US markets, may be ready to step in and fill the gap.

Feedstock availability in China

Supply tightness of waste PET bottles or PET bales is expected to be an important issue in China this year because collection infrastructure is lagging behind capacity growth in the flake and pellet segments.

Several recycled PET producers are expanding their flakes and rPET pellet production capacity, including Tianjin Incom Resources, Ningxia Lima and Jiangsu Jiulong Regenerated Resources, because of robust demand from recycled PET fiber, home decoration and other applications. But collection of waste plastic has lagged behind this growth. Some upgrades have taken place in recent years, but overall collection efficiency is still low and unable to fulfil demand, while imports are not an option because China has banned bringing plastic waste into the country since 2018. The slow development of collection has tightened the PET bale market, lifting prices and hindering the production and sale of rPET flakes and pellets. Flakes and pellet producers will be hoping for improvements in 2024 to support the development of recycling in the country.

Asian PET depolymerisation development

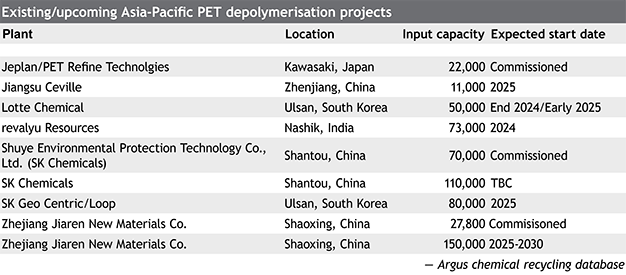

The development of several chemical recycling projects in northeast Asia will be something to watch closely in 2024, with a number of companies in the region working on depolymerisation technologies for PET waste to meet demand for rPET with the same technical qualities as virgin material. South Korea’s Lotte Chemical is revamping its existing Ulsan production lines to provide the capability to produce chemically recycled rPET, compatriot SK Chemicals has bought Guangdong Shuye’s BHET and rPET units to strengthen its recycled plastic business, and SK Geo Centric has announced ambitious plans to build chemical recycling capacity in South Korea. It will also seek suitable partners to build a chemically recycled PET plant in China, where local producer Zhejiang Jiaren has announced a plan to build a 150,000 t/yr chemically recycled PET plant to meet increasing demand for recycled PET fiber and feedstock dimethyl terephthalate (DMT).

In Europe and the US, a number of companies – notably Eastman – are advancing PET depolymerisation projects. But a lot of early focus in chemical recycling has been towards pyrolysis for mixed plastic waste streams. Here, while progress has been made with production at the first wave of plants now starting to ramp up, there have been understandable challenges with technology and the supply chain when moving from demonstration to commercial scale. The challenge of scaling up depolymerisation for a monomaterial waste stream is likely to have some common elements with pyrolysis but it is also a different beast. It will be interesting to see how supply of — and demand for — chemically recycled PET develops in the coming years, with Asia seemingly at the forefront.

India recycled content targets

In a bid to tackle India’s plastic waste pollution problems, its government has outlined plastic recycling targets as part of an EPR scheme due to begin this year. The directive from the environment, forest and climate change ministry stipulates that producers, importers and brand owners recycle 30-50pc of plastic waste across various types of plastic packaging, increasing to 60-80pc by 2028.

The country is also implementing mandatory average content requirements of 30pc recycled content (per enterprise) for rigid packaging, 20pc for flexible packaging and 5pc for multilayer packaging, which come into effect on 1 April.

These targets are ambitious, market participants say. Given the high level of informal waste collection, particularly in urban areas, collection is unlikely to be a problem. The largest challenge is ensuring a steady stream of viable feedstock, as bale quality varies greatly between collections. This poses a further issue as the majority of collected waste that does not pass quality controls ends up in landfill.

India is developing recycling capacities, and its recyclers are increasingly applying for and being awarded European Food Standard Authority (EFSA) and US Food and Drug Administration (FDA) certifications for recyclates. But market sources claim the pace of capacity expansions in tandem with higher collection rates is too slow. Indian plastic industry association Plastindia expects domestic rPET flake demand to reach 600,000 t/yr by 2025.

This article was created by recycled polymer experts using data and insight from Argus Recycled Polymers. Request a free trial or more information here

Author Argus, Will Collins