Scroll down or navigate to each regional commentary using the buttons above.

Global LPG markets strengthened in January, led by higher Asian propane prices, tight supply, and strong winter demand. Japanese premiums surged, while Chinese PDH units cut runs amid rising feedstock costs. Europe saw propane hit a nine‑month high as Asian demand diverted US cargoes, though local exports improved. In the US, propane prices eased despite high stock draws and weather‑related production cuts. Looking ahead, prices are expected to soften seasonally, with longer‑term trends shaped by crude markets, Middle East supply growth, and easing freight rates.

Asia-Pacific

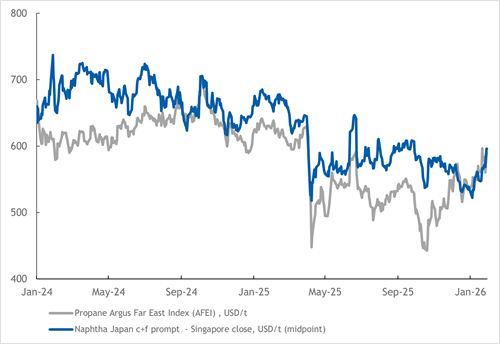

Global Propane Prices

- Average delivered propane prices into Japan rose by 3.4pc in January compared with the previous month, supported by gains in crude prices.

- Strong demand and tight supply for February shipments pushed spot premiums to $48/t against the February Argus Far East Index (AFEI), while first-half March cargoes commanded premiums as high as $60/t to the March AFEI.

- Higher exports of evenly split cargoes from the US to India and Southeast Asia reduced the availability of pure propane cargoes.

LPG versus Naphtha

- Strength in the LPG complex, driven by peak heating demand, rendered propane and butane uncompetitive for feedstock switching at flexible crackers.

- Front-month propane swaps averaged a $13/t discount to naphtha in January, despite $40–50/t cash differentials required to secure LPG supply for February.

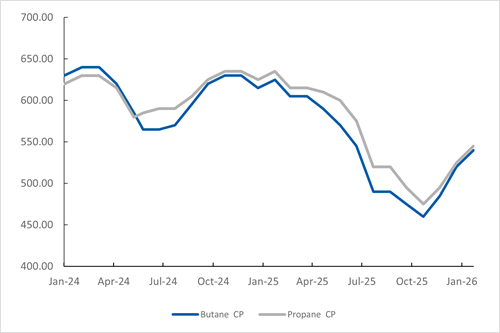

Saudi Aramco Posted Propane & Butane CP

- Saudi Aramco increased its February Contract Prices (CP) for propane and butane to $545/t and $540/t respectively, up by $20/t from the previous month.

- Firm crude prices and a strong Asian delivered market supported the monthly increase, despite softening demand for February-loading cargoes.

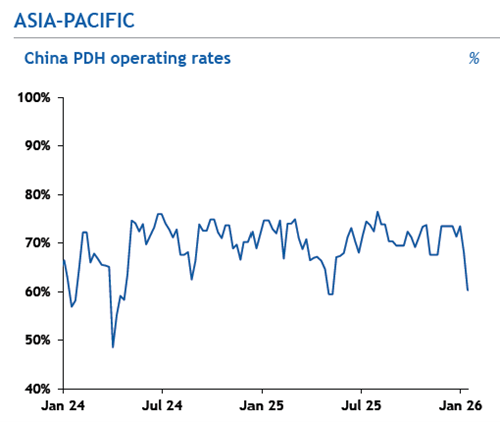

Chinese PDH Performance

- Surging propane feedstock costs drove significant production losses, pushing run rates at Chinese PDH plants lower.

- PDH operating rates fell to around 60pc by end-January, the lowest since May 2025, as operators grappled with low inventories and rising import costs.

Europe

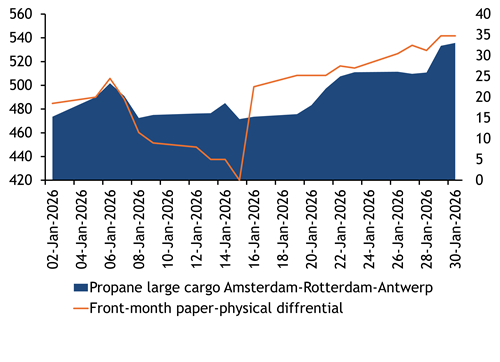

Northwest European largo cargo propane prices rose by $62.25/t to $535.75/t by the end of January, reaching a nine-month high. This was due to product availability being tight in the region as Asia had a strong pull on US cargoes, hindering propane supply coming into northwest Europe.

Local propane availability recovered in January after months of subdued activity. LPG exports from the six major terminals – Mongstad, Hound Point, Teeside, Melkoya, Sture and Karsto - rose by nearly 18pc on the year to 467,000t. The increase came after a weaker export environment for much of 2025, when high US LPG imports kept propane and butane prices consistently priced at discounts to the local natural gas benchmark TTF, reducing the economic incentive for North Sea producers to recover LPG from the gas stream.

Pricing relative to local crude oil futures ICE Brent opened January at 63.5pc and weakened to just under 61pc by the end of the month.

America

Mont Belvieu, Texas, prompt-month LST propane prices averaged 64.44¢/USG ($335.73/t) in January, down from an average of 67.14¢/USG in December, as declines in Asia and an oversupplied domestic market weighed on prices.

US propane inventories fell to 82.7mn bl at the end of January, according to the US Energy Information Administration (EIA), leaving stocks up 37pc versus the five-year average. Upstream freeze-offs at gas processing plants due to a winter storm at the end of January curbed US propane production by 418,000 b/d in the last week of January, less than half of the curtailment seen in prior storms. The freeze of February 2021, for example, cut US propane production by about 900,000 b/d, according to the EIA.

Throughout the weather, US propane exports stood fairly steady, at 1.9mn b/d at the end of January.

Later this month the US is expected to receive the first 22,000t import of LPG from Venezuela since the ouster of former president Nicolas Maduro. The cargo aboard the Chrysopigi Lady arrived at the US East coast port of Providence, Rhode Island, on 7 February, according to Kpler tracking. Market participants believe the spot shipment of heating fuel this winter is not part of any larger term contract into the US.

Butane at Mont Belvieu, Texas, averaged 75.71¢/USG ($342.97/t) in January, down from 83.22¢/USG in December, as domestic gasoline prices are weak, curbing blending demand. Butane’s value relative to Nymex gasoline futures averaged 41.9pc of Nymex RBOB in January, down from 57.2pc of gasoline futures in January of 2025.

Outlook

The quarter ahead

- LPG prices will begin to decline seasonally as winter heating demand subsides over the coming months

- Though the winter storm in the US has drawn down stores, LPG inventories are expected to remain strong

- If tensions between the US and Iran begin to ease, prices could fall rapidly alongside crude

The next 6 months and longer term

- Stronger crude and naphtha prices towards the end of 2026 will boost LPG

- Growing Mideast production and muted Asia demand increases will keep LPG weak relative to naphtha

- VLGC freight rates are expected to weaken over 2026, narrowing regional spreads

Argus Market Highlights LPG

If you’d like to receive an email notification when we publish our monthly newsletter — featuring news analysis from Argus LPG World, podcasts, and market insights — sign up here to get the next issue delivered to your inbox.

Sign-up