The latest research from Argus LPG World shows that global LPG storage capacity has continued to expand, while the survey captures more facilities than ever before.

More in store

Since the last Argus LPG World Storage Survey published in summer 2022, capacity has risen again, with growth again driven predominantly by projects opening in China.

The country’s investment in new petrochemical production facilities fed with imported LPG has propelled further growth in storage space. Another six storage facilities have been included to the global list, now available for the first time to subscribers as a data download through Argus Direct. Of these, four storage facilities — in Maoming, Taixing, Ningo and Lianyungang — are associated with new propane dehydrogenation (PDH) projects, adding a combined 471,000t in capacity. The final two in Yangpu and Zhejiang are integrated with ethylene crackers, and add 92,000t. Another import addition is Oriental Energy’s 750,000t underground storage cavern in Ningbo, which was included last year but was only recently commissioned.

The new facilities bring China’s total to 126 with a combined capacity approaching 5.9mn t, an increase of more than a quarter from 5.3mn t in 2022. This growth has coincided with China’s PDH capacity rising to 18.5mn t/yr in November from 13.7mn t/yr a year earlier, with eight plants opening in 2023, many of which are being fed with increasing propane imports from the US and Mideast Gulf. Chinese LPG imports are on course to have increased by a fifth on the year to 28.6mn t in January-November, the latest data from Vortexa show, while US and Mideast Gulf exports will have grown by 11pc and 3.3pc to 52.4mn t and 40.5mn t, respectively. The import and export terminal projects that facilitate such growth rely on new or expanded storage sites, pushing up the global total.

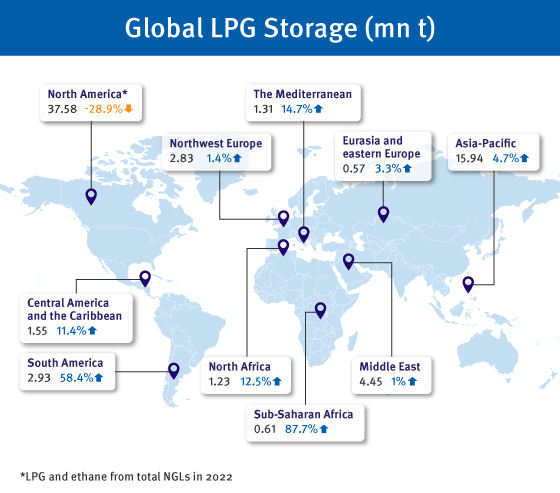

The total number of storage facilities in the survey — with a capacity above approximately 1,000t — now stands at nearly 1,300 with a combined capacity of 68.9mn t, compared with 1,120 plants at 82mn tin 2022. The explanation for the drop in capacity is Argus’ new estimates for US and Canadian storage facilities, broken down into LPG and ethane rather than total natural gas liquids. This puts US LPG and ethane storage capacity at 37.6mn t, down from 52.9mn t, although the number of facilities grows to 115 from 103.

Sub heads

The survey also captures far more of the small storage facilities in the sub-Saharan African region, some new and expanded, others captured for the first time. The number of regional facilities rises to 52 from 35, with combined capacity up to 554,000t from 325,000t. Storage units in Angola, Gabon, Madagascar, Mauritania, Mozambique, Congo (Brazzaville), Sierra Leone and Togo are included for the first time. In Nigeria, where the government is pushing its LPG expansion programme that has prompted investment in new seaborne import terminal infrastructure, to absorb not only more imports but supplies from the country’s Bonny Island LNG plant, the number of facilities rises to 16 at 226,000t combined from 13 at 206,000t. This will continue to rise with projects in the near-term pipeline with capacities of 11,000-20,000t, and longer term for projects of 30,000t and 50,000t.

In east Africa, Kenya opened the expanded Kipevu Oil Terminal in Mombasa in August 2022 — a floating facility that can accommodate VLGCs. Kenya hopes the terminal will help the country become a supply hub for the Great Lakes region, as well as grow domestic supplies and re-export LPG to Indian Ocean islands such as Zanzibar, Seychelles and Mauritius. The country is working on a $131mn, 30,000t facility in Mombasa alongside Tanzania’s Taifa Gas to provide more storage capacity, which is expected to open either late this year or in 2024.

Angola is establishing a 60,300t storage facility, with state-owned Sonangol receiving 34 storage cylinders from China for its Bande terminal project in September. The first phase is due to start up in 2024, according to the oil ministry.

Author Matt Scotland, Editor

Stay informed with Argus LPG World

Argus LPG World provides valuable context to key trends and the latest developments for LPG markets. The service includes a special biennial report on global storage volumes and detailed analysis on what has changed, where and why. Now, for the first time, this data is being captured in ongoing research by the Argus team and made available to subscribers as downloadable data.

As well as insight into storage capacities, Argus LPG World supplies industry and company news, market fundamentals, shipping information and monthly prices. It is considered an essential tool in staying on top of the global LPG markets.

Try it out with a recent sample report