Local supply of renewable diesel has tightened in March. March batches on KM pipeline system were cut after some shippers were long in February and marine deliveries have slowed.

Renewable diesel production capacity is set to double by the end of 2027. With this anticipated growth over the coming years, it is critical to ensure fair and reflective values are provided for market participants. As the leading source of global renewable diesel pricing intelligence, this monthly market wrap will shine a light on this relatively new and fast paced market and provide visibility to price indicators.

An estimated 141,000 bl of offshore renewable diesel have arrived at US west coast ports as of 21 March, compared to nearly 843,000 bl recorded in February, according to bills of lading. At least three additional vessels are expected from Singapore by the end of the month, plus two shipments currently scheduled for April arrival, per data from global trade analytics platform, Kpler. Deliveries from the US Gulf coast to the west coast appear to have also thinned in recent weeks. Kpler data show just two Jones Act vessels have brought renewable diesel to California from the US Gulf coast 0since mid-January: the Overseas Houston and the California Voyager to northern and southern California, respectively, at the

end of February.

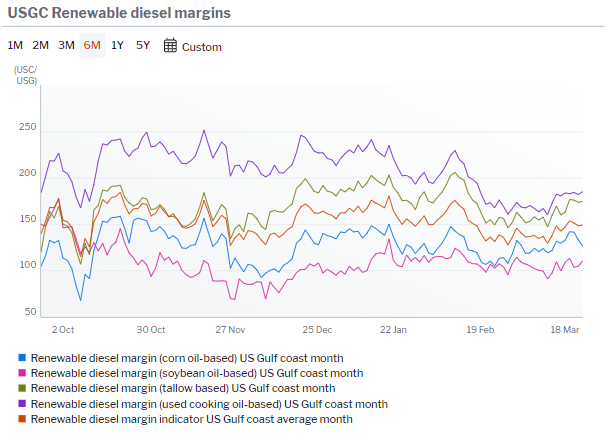

Renewable diesel margins in the US Gulf coast have recovered in recent days, after deteriorating for much of February. Average margins across all feedstocks were measured at 151.2¢/USG on 20 March, which is 10¢/USG above the March month average and 12.4¢/USG above the same day prior month.

The California Air Resources Board last month postponed a hearing and potential vote on proposed low-carbon fuel standard changes. The proposals, published in December, included a more stringent target of a 30pc reduction in transportation fuel carbon intensity by 2030, mechanisms to automatically make the program tougher when new credits outstrip new deficits by certain levels, and other modifications to the eligibility of certain fuels to create credits and deficits. CARB plans to modify proposed changes to its LCFS program in time to still have them take effect in 2025.

Argus launched independent price assessments for the California R99 spot market in November, to help drive enhanced visibility. Learn more about these prices.