Marine lubricants are a way to help the shipping industry decarbonise, not just by using alternative and greener fuels.

The International Maritime Organisation and the EU are imposing stricter standards to reduce carbon emissions from the shipping industry. The bodies have each published respective targets for carbon reduction, with up to 100pc reduction by 2050.

Although the shipping industry is the most environmentally sound — accounting for 3pc of world emissions — it can look towards more innovation and technical solutions to drive down carbon emissions, Danish re-refiner Avista Green commercial director Tommi Jarvinen said.

Jarvinen said using re-refined base oils (RBOs) as a basis for marine lubes or cylinder oils is a crucial way to reduce a company's carbon footprint, as well as help improve fuel efficiency, Jarvinen said. An estimated 2,000 litres of marine cylinder oil is used each day, depending on the size of the vessel. This is used in vessel engines, and so using an RBO-derived cylinder oil would be vital to reducing its carbon footprint.

RBOs can provide a CO2 saving of up to 85-90pc compared with equivalent volumes of virgin base oils.

Avista Green recently told delegates at the UKLA's Succession & Sustainability Conference in London that the lubricant industry needs to transition from a linear economy to a circular business model.

Avista Green's Vladimir Dhondt suggests that using re-refined base oils can help companies cut down their CO2 emissions by up to 85-90pc compared with virgin base oils.

The producer of re-refined base oils saves the waste oil from previously-used finished lubricants to produce new base oils instead of disposing of the material after one application.

Although there are environmental advantages of re-refined base oils, the market is still uncertain about their properties compared to virgin oils. And re-refined material is often still perceived as "the black stuff", said UK-based Slicker Recycling's Mark Olpin.

"We need to fight the scepticism," said Dhondt. "Quality is one of the advantages we need to sell."

One challenge of the circular business model is collecting enough waste oil to produce refined base oils. Dhondt said that more than 50pc of collected used oils do not go into the re-refining process. This creates a tightness of availability of the raw material for re-refined production.

Selecting a customer base committed to sustainability is key to improving waste oil collection. This is done by ensuring buyers return the product to the waste collector once it has been used, said Dhondt.

He said that bringing back the used oils to the market incentivises producers and buyers to "wave the sustainability flag" and "promote the product as a sustainable product." This can raise customers' awareness about the quality of re-refined material, helping to expand the market.

.png?rev=6b06ad0a27df4d5589eb370da14a550b&hash=E382761160BE1C94939C639A0CA01360)

European market interest in re-refined base oils peaked when Russian-origin virgin products exited the market because of the war in Ukraine. The tightening supplies saw Argus-assessed Group I domestic SN 150 prices surge by 25pc from the end of February to the end of March 2022, to $1,220/t. Security of supply is a crucial concern among blenders keen to avoid price volatility, and the development of re-refined base oils through the circular economy is a solution.

While re-refined base oils can reduce fuel consumption in the marine industry, alternative marine fuels remain key to EU ETS legislation compliance. Learn more about Argus Alternative Marine Fuels here.

Author Gabriella Twining, Global Base Oils Editor

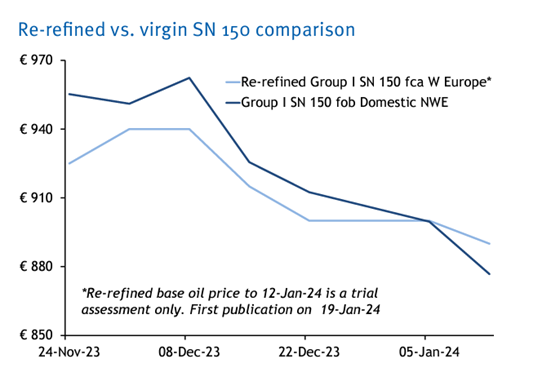

Argus has launched the first re-refined spot price assessment in the world for Group I SN 150 — for Western Europe on a FCA basis. This assessment is based on reported deals, bids and offers and will give the market transparency on the price of SN 150 made from waste oils. The price is published in Argus Base Oils.

Download new price FAQ