Russian coal freight rates have dropped below levels seen in 2022. The market has experienced significant upheaval owing to events of the previous year, but participants have apparently adapted to the new environment. Rates are aligning with global trends, which were characterised by a downward movement in global dry bulk rates during the first half of 2023.

To enhance transparency in the freight market, Argus in June introduced nine freight rates for Russian-origin coal shipments to China, India, South Korea and Turkey.

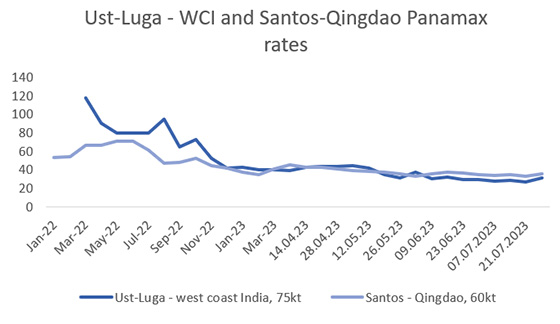

The start of the Russian-Ukraine conflict in February 2022 caused panic in all markets, including the freight sector, resulting in a surge in freight rates. For instance, the Panamax rate between Ust-Luga in the Baltic region and the west coast of India (WCI) spiked to around $120/t in March 2022, according to market participants.

Following the initial shock, a second emerged when Europe closed its doors to Russian coal. The ban on Russian coal in August 2022 extended to the entire continent, following Poland and the Baltic countries' earlier decisions. As a result, Argus suspended freight rates on the Murmansk-ARA route.

Global coal routes reshuffled as shipowners avoided Russian ports. This triggered a second surge in rates, with the cost of freight from Ust-Luga to WCI rising to almost $100/t.

But it was later clarified that companies could still transport coal to third countries with insurance coverage. Subsequently, Russian coal freight rates stabilised and began following global patterns in the dry bulk freight market. Many major shipowners have since returned to Russian ports.

As freight rates from western Russian ports have aligned with global trends, they are now lower than they were two years ago. For example, the Capesize rate on the Taman-China route was around $29/t in May 2023 and below $23/t at the end of June 2023, compared with $33/t in May 2021.

Typically, Russian (and Ukrainian) charterers pay a war risk premium. For Russian cargoes, the war risk premium is usually around 1pc of the vessel value in the Black Sea, which amounts to $210,000-250,000 for a Panamax and $300,000 for a Capesize. In the Baltic region, the premium is around 0.25pc, equivalent to approximately $50,000 for a Panamax, according to brokers estimates. But during the summer of 2023, some shipowners have agreed to carry Russian coal without the war risk premium, aiming to reduce costs, traders say.

The profitability of the western routes from Russia is declining owing to tepid coal demand in the Asia-Pacific region and sliding global coal prices. While some large companies such as Suek can reduce handling costs at their own ports (e.g. Murmansk), most Russian coal companies face a less attractive environment in 2023.

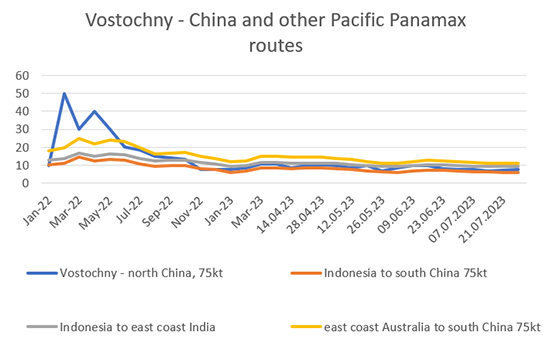

In the eastern region, a similar trend has been observed in the freight market, albeit without a second peak in August 2022, as Europe does not factor into the equation, nor do war risk premiums. Overall, rates have returned to normal and have been following global patterns since autumn 2022. This means that current freight rates in the far east are lower than observed two years ago.

For instance, the cost of freight from Vostochny to north China dropped to $7/t in July 2023, compared with $11/t in May 2021.

Certain major charterers are attempting to avoid vessels associated with Russian ports, known as "Russian callers", thereby exerting additional pressure on freight rates for such ships. But when market conditions are unfavourable, charterers may change their stance. For example, one of the largest South American iron ore producers offered several Capesizes and Newcastlemaxes on the market earlier this year, when global demand for iron ore was low. Russian coal companies also had access to these offers, according to market participants.

Another concern pertains to the significant increase in the age of the fleet, which may pose challenges in terms of decarbonisation and compliance with International Maritime Organization (IMO) regulations in the future.

The average age of bulkers calling at Russian coal ports has risen by 60-75pc. In April 2023, the average age at Ust-Luga jumped to 14.2 years from 8.1 years in April 2021; at Murmansk to 13.3 years from 8.3 years; at Taman to 16.6 years from 9.9 years; and at Vostochny to 19.1 years from 11.9 years.

Major shipowners are taking advantage of this situation to find buyers for older vessels. For instance, Norway's Golden Ocean sold the Golden Ice (2008) and Golden Strength (2009) for a total of $30.3mn in November last year. These vessels, renamed the Ice II and the Strength, are now operating between Ust-Luga, Taman and Turkey.

In January 2016, Danish group Norden sold its final for that moment Capesize vessel, the 2004-built Nord Energy, owing to low market rates and declining vessel values. The vessel was subsequently renamed the Beks Ice and has mostly been used on the coal route between Russia and the Asia-Pacific region since May 2022.

In the short term, there is a risk of frequent incidents involving overaged vessels. For example, the 2005-built Beks Force, another ship owned by Turkish company Beks Shipmanagement and Trading, experienced a minor fire in its engine room three weeks ago. The vessel was en route to Vostochny to load a coal cargo after delivering another Russian cargo from Taman to South Korea, as reported by FleetMon.

Overaged vessels such as the Beks Force were acquired by Turkish shipowners last year for $17.25mn, according to Seasure Shipbroking. Although the damage was reportedly not severe, the vessel spent approximately two weeks near Vostochny before continuing its voyage to Dalian.

Thus, Russian coal freight has adapted to sanctions and rates have followed global patterns — lower now than in 2021 despite some flaws including an ageing fleet and war risk premiums. Nobody knows what will happen tomorrow in Ukraine — peace or endless conflict, trade corridors or ships under fire in the Black Sea.

The Ukrainian defence ministry said that all vessels sailing to Russian and Ukrainian ports occupied by Russia in the Black Sea will be considered as "those which carry military cargoes, with all the risks that come with it", starting from 00:00 on 21 July. Ukraine also banned all navigation in "areas of the northeast Black Sea and Kerch-Yenikale Canal, the Ukrainian part of the Kerch Strait", starting at 05:00 on 20 July. This came about after Russia refused to prolong the Black Sea "grain deal" along with a Russian defence ministry statement that all vessels travelling through the Black Sea to Ukrainian ports will be considered "as potential carriers of military cargo". Russia also struck Ukrainian deep-sea ports Odesa and Chornomorsk and Danube river ports.

Market participants think that vessel movements from Russian Black Sea ports will persist, but freight rates in the Black Sea and alternative basins may rise and the cost of insurance will definitely increase alongside.

Last week, Russian coal producer Elsi fixed the 175,462dwt Edwin from Taman to Caofeidian, China, from 4-24 August at $25/t — $3.50/t higher than the week before. It might be a first sign of rising freight rates in the Black Sea. The war risk premium also increased from 1pc to 1.5pc of a vessel's value in the Black Sea.

Fundamental challenges for Russian coal companies exist too. Australian coal recently returned to China and its premium to Russian product is fading. China and India are increasing their domestic coal output. And lower freight rates could support their position on the market until the winter and a new seasonal peak in coal demand.

Author Andrey Telegin, Senior Reporter

Learn more about Argus Freight

Download exclusive limited edition content