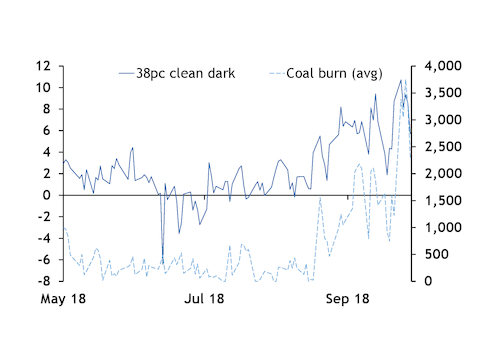

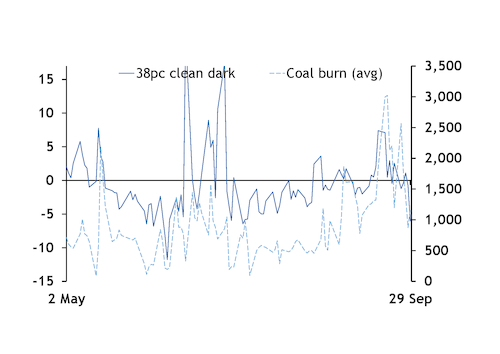

UK coal-fired power generation rose on the year in September, reversing the trend of year-on-year declines.

Average coal burn last month was slightly above 1.7GW, up from 1.4GW in September last year, and bucking the recent downward trend. In three of the four months preceding September, the UK burned between half and a third as much coal as it had that month a year ago (see chart).

The resurgence of coal burn was driven by wider clean dark spreads. The average day-ahead 38pc carbon tax-adjusted dark spread last month was £6.62/MWh, with no days with a negative spread. In September 2017, the average 38pc carbon tax-adjusted dark was £0.48/MWh and a majority of days had negative spreads (see chart).

Coal-fired plant profitability rose in spite of a 300pc increase in the price of EU emissions trading system (ETS) allowances this year. The EU ETS gains have directly increased the costs of operating coal plants to a greater extent than they have for gas-fired plants. But because the prices of NBP gas contracts have been driven higher this year — the September NBP gas contract expired as the front month last week at 68.48p/th, compared with 45.20p/th for the September 2017 NBP contract — the total fuel cost for gas-fired plants has risen even more sharply than for coal-fired plants. With European gas stocks still in need of injections going into winter, operators cannot afford to burn additional gas for power and have lifted NBP and TTF prices to prevent coal-to-gas fuel switching on the continent.

Until late last week, coal burn faced a strong outlook this month, with average-efficiency clean darks in double-digits and coal-fired plant availability due to return to just shy of its winter peak of 10.3GW. The 38pc October clean dark reached a contract high of £11.11/MWh on 25 September, far above the October 2017 clean dark expiry of minus £0.73/MWh. But as power prices retreated while the EU ETS market mostly holds its ground, clean darks have lost nearly half their value and expired on 28 September at £6.38/MWh.

In October 2017, the UK burned 1.2GW of coal for power.

Clean darks were likely to lose still more ground today, further eroding the outlook for coal profitability.