Indian demand for imported urea could fall from 2019 as the country takes a step forward in its aim to become self-sufficient by increasing its own domestic production. But scepticism runs high, as it is rare for new urea units to start up and achieve full production on schedule.

India is one of the biggest buyers of urea globally, and farmers typically consume 30mn-31mn t/yr of urea, of which roughly 24mn t is produced domestically and the rest imported.

India during April-December 2018 bought about 4.8mn t of urea and will take 1.8mn t in 2018 from its Omifco joint venture with Oman.

A new tender is expected to be announced in the first quarter of 2019, which may see another 600,000-800,000t being imported. Argus forecasts that India will import over 7mn t in 2018-19.

Domestic production totalled 13.7mn t during April- October, official statistics show, an annualised rate of 23.5mn t.

To reduce dependency on imports and move towards self-sufficiency, several urea projects are in the pipeline.

Assuming full production is achieved in a timely manner, Chambal Fertilisers' Gadepan 3 unit and FCI's Ramagundam unit could cut India's import requirements by more than 2mn t in 2019-20. Imports through tenders could fall to less than 3mn t as a result.

Chambal announced on 30 November that it had begun trial production at its Gadepan 3 unit at Kota in Rajasthan state. The 1.3mn t/yr plant is the first new urea project to start up in India for many years. Commercial production at Gadepan is scheduled to start in the 2019 first quarter when the trials are completed.

Investment revival

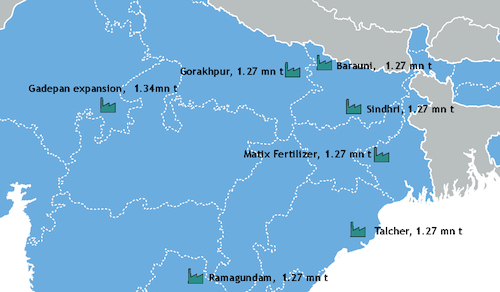

The government is also planning to invest $7.8bn in fertilizer plants in east India, under a project called the sick units revival plan Surp. The first project, FCI's 1.27mn t/yr gas-based plant at Ramagundam in east India, is scheduled to be commissioned in the first quarter of 2019.

The Ramagundam plant will be supplied by gas from the Mallavaram terminal in Andhra Pradesh, by a subsidiary of Gujarat State Petronet (GSPL). A gas transport agreement was signed in July 2016 for 20 years.

Surp involves revamping or rebuilding ammonia and urea plants at Gorakhpur, Barauni, Sindri and Talcher. The four plants each have nameplate capacity of 1.27mn t/yr of urea.

Work has already started at Talcher, the first coal gasification project in Odisha state, which will produce urea and synthetic gas from coal and petroleum coke. It will have a capacity of 1.27mn t/yr of urea and 700,000 t/yr of ammonia and is scheduled to start operations in 2022.

The Gorakhpur unit may come on stream by 2020-21. The earliest start-up date for the Sindri and Barauni units is estimated at 2021-22. These plants will be supplied by gas through the Jagadishpur-Haldia pipeline, which is being developed by India's state-owned gas distributor Gail. The pipeline will link eastern India to the national gas grid.

There have been discussions among market participants about the restart of Matix's 2,200 t/d ammonia and 3,850 t/d urea units at Panagarh, West Bengal. The coal-bed methane gas-based plant started up in late 2016 but insufficient feedstock promptly led to its shutdown. Plans to link the Matix plant to the LNG terminal at Dhamra are currently under way, with a possible 2019 restart.

A clearer picture on the new projects will only emerge by the second half of 2019. The increase in domestic production will weigh on imports, but a more pronounced effect will be noticeable in 2020 at the earliest.