US shale oil production looks set to fall further until prices rebound to levels that support greater investment in new capacity.

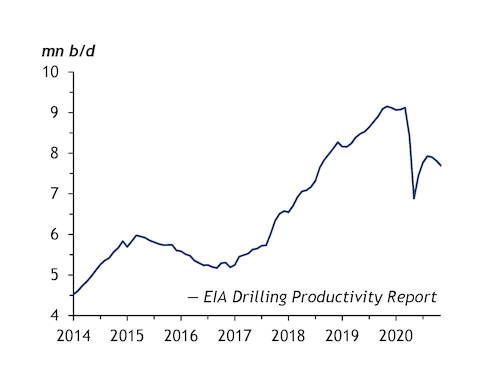

Output bounced back strongly this summer as operators unwound deep voluntary curtailments totalling more than 2mn b/d that they made in April-May. Oil production rose by 1mn b/d in June-August in the seven shale formations covered by the EIA's Drilling Productivity Report (DPR). But the DPR expects lower output in September-November as production at new wells proves insufficient to offset legacy declines at existing ones (see graph).

"Oil prices are currently too low to sustain replacement drilling," an anonymous respondent to the latest Dallas Fed Energy Survey says. A majority (19pc) of 112 exploration and production firms surveyed in mid-September say their primary goal for the next six months is to maintain output, while others aim to boost production, reduce debt or find additional sources of capital (16pc each). Most (44pc) of the 162 oil and gas firms responding expect WTI prices to be in the recent $40-45/bl range at the end of this year.

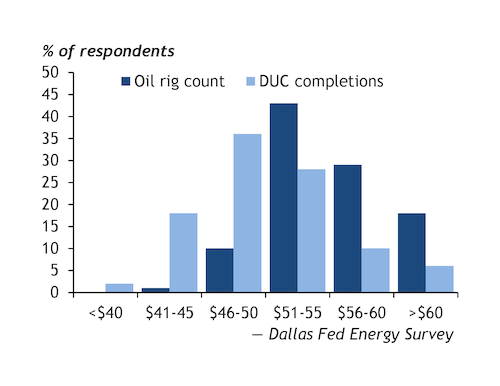

Yet $40-45/bl WTI is not high enough for shale oil output to stage a recovery. US oil rig counts are slowly rising after a dramatic plunge in March-June, but the number of active drilling rigs is still less than a third of March levels. And nearly 90pc of survey respondents say at least $50/bl is necessary for a "substantial" increase in rig counts (see graph). With prices stalled at about $40/bl, operators are cautiously drawing on their backlog of drilled-but-uncompleted (DUC) wells for new capacity. A fifth of survey respondents expect DUC completions to pick up at $40-45/bl and more than half at $50/bl.

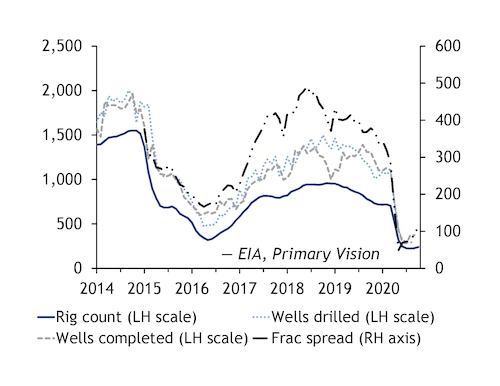

Well completions in the DPR regions jumped by a third to 372 in August-September from a low of 282 in July, while the number of new wells drilled (295) in September was almost unchanged. But there are still not enough new wells starting up to offset legacy declines as too few "frac" fleets or crews are being deployed. "It takes about 165 crews in the oil basins to keep US oil production flat at our now-projected end-of-year production rate," oil service company Liberty Oilfield Services chief executive Chris Wright says. Together with "25-30 crews to run the gas basins, to keep gas production roughly flat", he expects to see 125-130 crews operating in the US by the end of this year. But you "probably need 190-200 just to hold US production flat" and "another 80-85 crews to grow US production by 1mn b/d", he says.

Crew cuts

The number of active frac crews has more than doubled to about 115 from a low of 45 in mid-May, according to fracking industry monitor Primary Vision, as operators crank up completions (see graph). Yet this is barely a third of the crews operating in February-March before the pandemic struck and — crucially — less than two-thirds of the number needed to keep output flat. Primary Vision's weekly "Frac Spread Count" estimates the number of active fleets from drill site activity and hydraulic fracturing fluid and proppant pumping volumes.

Opinions are divided about whether US production can ever recover from its recent collapse. "It will be just too difficult to replace the 2mn b/d that we have lost and grow beyond that," Occidental Petroleum chief executive Vicki Hollub says. She sees some of the lost output coming back over the next three to four years as demand recovers, but does not see US production returning to its peak of nearly 13mn b/d. But it is clear that any recovery in output depends on higher oil prices. The longer oil prices are low, the more output will fall and the wider the gap to be filled before peak capacity is restored.