UK ferrous scrap delivered to dock prices have risen to multi-year highs, driven by a strong seaborne market combined with ongoing logistics issues and strong competition between exporters that have increasingly shifted towards sacrificing margin in favour of significantly higher sales.

The Argus weekly delivered UK dock assessments for HMS 1/2 reached £305-315/t on 8 February, the highest level since Argus began pricing this market in May 2018.

A renewed uptick in the Turkish ferrous scrap import price past $500/t has been the main short-term driver for this UK dock increase. The Argus daily HMS 1/2 80:20 cfr Turkey assessment was at $508/t on Friday.

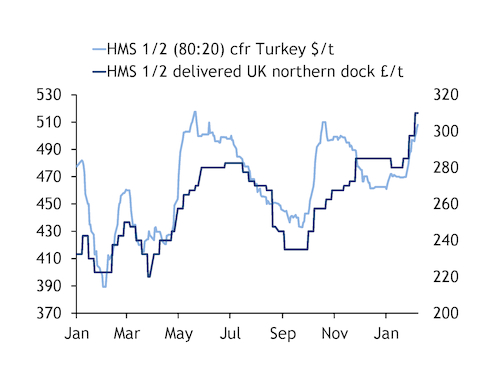

But UK dock prices are currently much stronger relative to the Turkish import price compared to when Turkey went past $500/t in May and October last year, reflecting underlying dynamics in the UK market that have lifted prices higher (see graph).

The midpoint of the Argus assessment for HMS 1/2 delivered to northern docks was £40/t lower than today at £275/t when the HMS 1/2 80:20 cfr Turkey price peaked at $517.60/t on 26 May 2021, and £47.50/t lower at £257.50/t when Turkey hit its October peak of $510/t on 22 October.

UK dock prices usually lag seaborne increases, and in both the May and October cases UK dock numbers subsequently rose in the following month as UK exporters began buying for cargoes sold at the top of the market.

But even peak UK dock prices for both of those sales periods were far lower than current assessment levels. The highest level the HMS 1/2 delivered to northern docks assessment hit following the May 2021 peak was £280-285/t throughout late June and most of July. And the post-October peak for UK dock prices was only slightly higher at £280-290/t, which was maintained throughout December.

What has been unusual in the current round of seaborne price increase is that there has been virtually no lag in the UK dock price response. The daily HMS 1/2 80:20 cfr Turkey assessment began its renewed ascent from 25 January onwards, rising by $38.50/t since then to $508/t on 11 February.

The delivered UK northern docks HMS 1/2 price has risen by £25/t over the same period, equivalent to a $33.99/t increase — almost in line with the Turkey rise.

This difference in price movement relative to Turkey compared to the 2021 peaks reflects tight availability of scrap flow in the UK amid fierce competition for tonnage. Truck and rail logistics issues intensified throughout the second half of 2021 and have persisted into 2022, leaving UK exporters with little option but to pay more to secure material.

Additionally, UK deep-sea ferrous scrap exports have increased sharply over the past two years, which has caused exporters to increasingly run on lower inventories, which has given them less flexibility to apply pressure to dock prices.

UK deep-sea ferrous scrap exports were estimated to total around 4.9mn t in 2021, based on vessel-tracking data collected by Argus — an 18pc increase on 2020 and 44pc higher than 2019. UK exporters are currently prioritising high volume sales in a strong seaborne price environment, which leaves less opportunity to control dock prices.

In this context, it is likely that UK exporters have been already moving to secure tonnage for sales done into Turkey for March shipment in the late $480s-490s/t range, which may mean that UK dock prices could stabilise for a short period and that the lag effect seen in previous Turkish peaks may not apply.