Argentinian farmers slowed wheat export sales of both new and old crop in the week to 20 July following the worsening outlook for 2022-23 production and with producers holding on to stocks to hedge themselves against a rapidly weakening domestic currency.

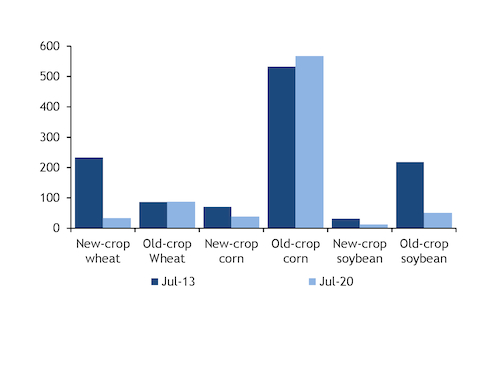

New and old-crop wheat sales for export fell to 33,200t and 53,700t, respectively, in the last reporting week, from 233,400t and 86,100t seven days earlier. Argentina's total old-crop wheat sales now stand at 21.04mn t, including 17.65mn t sold for export, while cumulative new-crop sales reached almost 5.11mn t, up from 4.34mn t a year earlier, with nearly the whole volume bound for export.

Hot and dry weather conditions during planting continue to drive various institutions to lower their forecasts for Argentina's 2022-23 wheat production, with the US Department of Agriculture Foreign Agricultural Service (USDA FAS) this week trimming its projection to 18.5mn t, compared with the USDA's official estimates of 19.5mn t, while the Rosario Board of Trade recently pegged it at 17.7mn t.

Also, farmers are trying to hold on to grain, as well as oilseed stocks, for as long as possible because of a rapidly weakening peso against the US dollar, since they make export sales in US dollars. But market participants said sales could pick up in the coming weeks, as farmers at present are being encouraged to sell stocks and inject US dollars back into the domestic market.

Corn, soybean sales mixed

For corn, old-crop export sales rose slightly to 567,700t in the week ending 20 July, from 532,500t a week earlier. Overall weekly sales for old crop stood at 1.08mn t, up from 1.04mn t in the previous seven days, with cumulative 2021-22 sales reaching 33.21mn t, lower than 34.58mn t a year earlier.

But new-crop corn sales dropped to 38,200t on 14-20 July from 70,100t a week earlier, with the whole volume headed for export. Total sales of the 2022-23 corn crop stood at 3.27mn t, compared with 5.12mn t over the same period a year ago.

Argentina's old-crop soybean sales also fell to 441,500t in the last reporting week from 516,300t seven days earlier, with 50,900t set for export — a sharp drop from 217,900t a week earlier. Meanwhile, new-crop sales were stable on the week at 111,800t, with almost the entire volume sold to local industry.

Cumulative 2021-22 and 2022-23 soybean sales so far have reached 20.88mn t and 890,700t, respectively, down from 25.78mn t and 1.22mn t at this point a year ago.