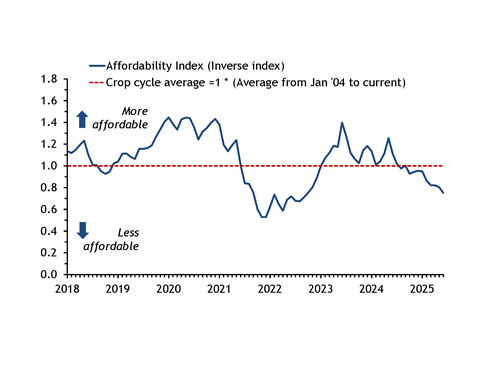

Global affordability for fertilizers has dropped to its lowest in nearly three years on a sustained increase in fertilizer prices — as strong global demand competes for limited supply — while crop values have dipped to the lowest since September 2020.

Nutrient affordability fell to 0.75 points in June, the lowest since September 2022, Argus data show.

An affordability index — comprising a fertilizer and crop index — above one indicates that fertilizers are more affordable compared with the base year set in 2004. An index below one indicates lower nutrient affordability.

The fertilizer index fell in June owing to higher fertilizer prices for phosphates while an increase in urea prices in June added further support to the index.

The Israel-Iran conflict firmed market sentiment across all nutrients in June, which has also added some volatility to freight rates.

Phosphate prices saw the largest gains, with June prices at the highest since September 2022 on persistent demand from India in the absence of inflows of Chinese DAP supply.

DAP prices have kept moving up as tight supply has kept driving the market at both sides of the Suez Canal. Chinese suppliers have been sitting comfortably with limited supply availability, which enabled them to increase offers in the face of African and southeast Asian demand. In the west, buyers have been struggling to secure limited MAP supply, also supporting prices.

On potash, MOP prices have reached the highest in two years driven by geopolitical uncertainty and robust demand in all major markets, particularly in southeast Asia, where affordability levels have been supported by excellent palm oil prices.

Meanwhile, on the potash supply side, availability was expected to be reduced from three major producers — Uralkali, Belaruskali and Eurochem — as they underwent maintenance works. Together, these works were expected to reduce MOP output by 1.3mn t across the first half of the year, further underpinning prices.

Urea prices rose to the highest in four months as the Middle East conflict pushed prices up on output curtailment while strong fundamentals — driven by Indian demand — continued to support prices.

On the other hand, the crop index — which includes global prices for corn, wheat, rice and soybeans adjusted by output volumes — have fallen to a near five-year low.