A significant portion of US fertilizer demand this fall may be at risk as tariffs limit supply and crop prices drop, pushing market affordability fundamentals to their worst level since April 2022.

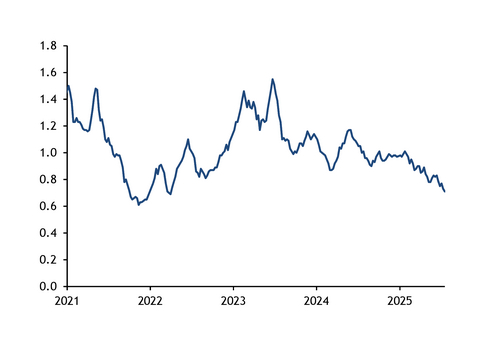

Fertilizer buyers, from wholesalers to growers at the farmgate, have a challenging fall application season ahead of them, according to attendees of the Southwestern Fertilizer conference last week in Nashville, Tennessee. The Argus fertilizer affordability index, a measurement of fertilizer costs relative to the price of a basket of crops, currently stands at 0.71 — well below the baseline of 1. The index began the year at 0.98 but has been falling quickly with the implementation of duties on US imports, as the domestic fertilizer market relies on offshore suppliers to meet demand.

The index is also being pulled down by the notable amount of corn acreage planted across the US this spring that, paired with favorable growing weather, raised the possibility of a bumper crop. Approximately 95.2mn acres of corn were forecast to be planted by farmers, the US Department of Agriculture said earlier this year, up from the 90.6mn acres planted in 2024 and a five-year-average of 91.3mn acres.

This year's corn crop will drain fertilizer inventories and nutrients from the soil across the country, while likely teeing up a massive crop that has depressed US corn futures. The December corn futures contract traded as low as $4.07/bushel on 14 July before rebounding to settle at $4.22/bushel on 21 July. Still, prices have fallen from a high of $4.80/bushel on 19 February.

Domestic fertilizer prices have rallied in recent months as tariffs restrict imports, only further undermining affordability.

Waiting before buying

Given these dynamics, wholesalers and retailers will likely wait to purchase a large portion of their fall fertilizer needs until demand is better understood, avoiding the risk of paying current prices and bearing the burden of storage and carrying costs.

Growers are expected to cut back most on phosphate and potash this fall. Nitrogen applications are more likely to be deferred until later in the season, as corn still offers better projected returns than soybeans and cotton. There could be some marginal acres that may skip corn planting altogether due to persistently high nitrogen costs.

Ammonia markets, in comparison, have yet to be directly impacted by import tariffs. But higher urea and UAN prices inflated summer fill offers to well above market expectations, coming in around $110/st above offers in 2024.

Despite this, ammonia remains the most affordable nitrogen fertilizer product on a nutrient basis and could maintain economic favorability during the fall if availability of other nitrogen products remains constrained by a lack of imports.

Tariffs keep the market on edge

US fertilizer prices are unlikely to come down in the near future as the market grapples with uncertainty related to tariff policy and the possibility of new, potentially harsher duties expected by 1 August.

When the current tariff policy was implemented in April by President Donald Trump, nearly all seaborne fertilizer imports became subject to a blanket 10pc tariff, making the US a less attractive outlet for exporters.

US phosphate imports have seen a dramatic response from the market, with most offshore DAP and MAP tons being kept off US shores.

DAP imports into the US for January through May are down by 22pc from the 2024-25 fertilizer year, while MAP imports by comparison are just 2pc higher, according to US Census Bureau data.

Tariffs also partly drove a nitrogen supply crunch this spring, with only one vessel of urea anticipated to arrive at New Orleans in July, based on vessel tracking data and market sources. The US nitrogen supply balance has been further strained by low inventories in India and recent production disruptions stemming from ongoing conflicts in Ukraine and the Middle East.

The absence of tariffs on Russia has given the US nitrogen market a crutch to lean on, but Trump has recently taken an increasingly adversarial approach to relations with the country, looking to provide arms to Ukraine and threaten more sanctions. The US Senate this month could vote on a Russian sanctions bill that would give Trump the legal authority to tariff Russian imports.

Trump's tariff rates could climb further on 1 August, with the administration threatening higher duties on a growing list of countries — including 30pc on Algeria and the EU, 25pc on Tunisia and Brunei, and 19pc on Indonesia — raising fresh concerns for US fertilizer importers. The US imported around 666,800t from these origins in 2024, accounting for about 13pc of all imports.