Pakistani domestic DAP prices have begun to slip since peaking in the first half of October. By realigning with declining international prices, lower domestic prices could force importers who bought DAP at higher levels to sell at a loss.

The latest range for domestic DAP prices spans 13,500-14,350 rupees/50kg bag ex-Karachi, with private importers offering at Rs13,500-13,800/50kg bag ex-Karachi.

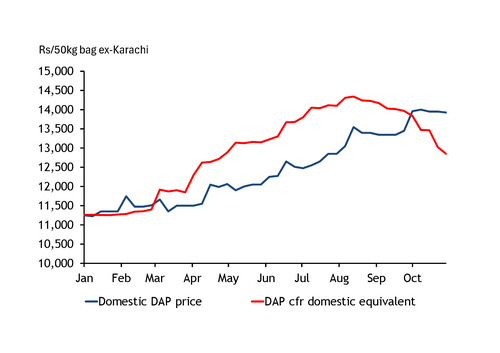

Import costs have been widening their discount to domestic levels since turning cheaper in early October. The domestic equivalent breakeven cost of the latest DAP assessment at $725-730/t cfr is now more than Rs1,000/50kg bag ex-Karachi below domestic prices at a midpoint basis, Argus data show. This is the widest discount since the start of 2025.

Imports on a $/t cfr basis are transferred into domestic prices by applying current exchange rates with the Pakistani rupee. Insurance, transportation and bagging costs add around 14pc. A goods and sales tax and a FED tax, each 5pc, also add to landed costs. This means that the peak of import prices at $815/t cfr in the second half of August at the midpoint was equivalent to breakeven landed costs at Rs14,341/50kg bag ex-Karachi.

Domestic prices have matched import levels with a delay of about two months over March-October. Import prices had moved above domestic levels in March, with the premium remaining above Rs1,000/50kg bag over most of May-August, while prices rose steadily. Importers who bought DAP during this period were counting on the continuing increase in domestic prices to secure positive margins when selling domestically.

But domestic prices never equalled the peak of import prices in the second half of August and have now started declining. Domestic prices peaked in mid-October at Rs14,000/50kg bag ex-Karachi at the midpoint, equivalent to about $793/t cfr when using the latest $/Rs exchange rate. Any DAP imported above this level would sell at a loss domestically.

The fall of domestic prices could be faster than the initial softening in cfr prices going forward. Suppliers will want to resist dropping prices to avoid high-cost imports wiping out profits made earlier in the year, but farmers that return to the market for the peak offtake season in November are pointing to the bearish international trend. Despite improving crop prices, the cancellation of the expected subsidy for DAP has hurt farmers' finances. Suppliers are holding onto healthy inventories, and some are understood to be eager to sell their stocks to avoid getting caught out by declining prices.

Up to 440,000t of DAP has been brought into Pakistan by private importers since May, line-up data show.

Some buyers have reported targeting import prices at $700/t cfr, a level not seen since mid-April. This would be equivalent to breakeven landed costs at Rs12,361/50kg bag ex-Karachi. If domestic prices drop by 9.4pc from current levels, unsold cargoes that were imported after mid-April would be selling at a loss.

The decline in domestic prices is less likely to cause losses for suppliers of branded and domestically produced DAP, which sell at a premium to private importers. But higher raw material costs is likely squeezing margins for Pakistan's domestic DAP production.