LPG buyers may scale back term purchases this year, but increased spot trade carries higher risk, writes Waldemar Jaszczyk

Northwest European downstream LPG buyers are set to return to spot trade this year after supply concerns driven by geopolitics and high natural gas prices led to heavy term buying in 2025.

Polish importers are leading the way in scaling back term commitments after adapting to the EU's ban on Russian LPG. The embargo, which took effect in December 2024, halted most of the 1mn t/yr Russia exported to Poland, prompting buyers to source supply from western markets. Fears of shortages spurred Polish buyers to lock in substantial 2025 term contracts early at record-high premiums to the large cargo cif Amsterdam-Rotterdam-Antwerp (ARA) benchmark.

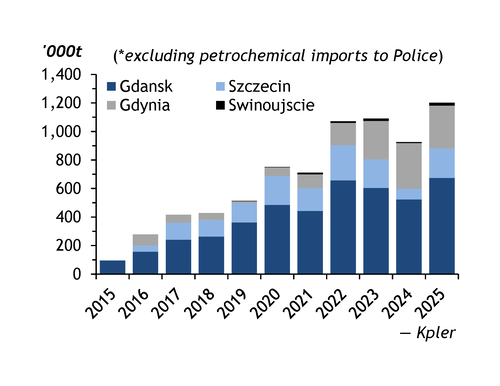

But this backfired as Poland ended up well-supplied owing to weaker autogas consumption and tumbling re-exports to Ukraine, leaving importers with excess term product. Baltic ports covered the loss of Russian rail flows, with seaborne imports for non-petrochemical use jumping by 30pc on the year to a record 1.12mn t by mid-December, Kpler data show. At the same time, weaker demand weighed on imports, which slid by 14pc to 1.58mn t over January-September — a 10-year low.

Polish distributors also faced competition from Latvia's Riga terminal, which started importing US LPG, undercutting other Baltic ports. Russian flows continued through a sanctions loophole, boosting imports of cheap normal butane and isobutane for Poland's 1.8mn t/yr autogas market. With profits plunging and buyers facing delivery backlogs, Polish resales to northwest Europe became common.

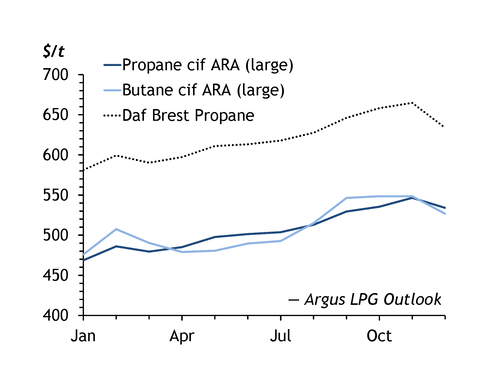

The return to spot markets has spread, to a lesser extent, to buyers in Germany, the region's key heating consumer. The prospect of Polish demand waves set the tone for Europe last year, boosting term deals. But other than brief spikes from refinery disruption, the shift in flows failed to lift spot premiums meaningfully. Fourth-quarter railcar and barge differentials averaged over $100/t below 2024.

Surging US exports allowed ARA terminals to absorb additional inland demand as transatlantic flows hit a record 1.7mn t. Many petrochemical producers also refocused storage to sell locally, increasing competition among sellers.

For 2026, refinery supply is expected to stabilise, if not increase, as the threat of rising natural gas prices has receded. Resurgent Dutch TTF values last year threatened to curtail refinery flows as they did in 2021-23. But propane was largely shielded from refinery use, with railcar assessments — a proxy for inland product — at a discount to the TTF only during the summer. Propane-burning economics collapsed after the TTF fell to a 20-month low in early December, while LPG supply was ample given mild weather. Forward curves show natural gas at only a marginal premium to large cargoes in 2026, reducing the incentive for refinery LPG use.

The propane market also weathered refinery closures in Europe, which removed 400,000 b/d of capacity in 2025. Further shutdowns are unlikely because tighter spare capacity supported refinery margins. Refinery supply in the region is forecast to hold at 16.35mn t in 2026 after a 5pc fall in 2025, according to Argus Consulting.

It's cold outside

The market enters this year with freezing temperatures across parts of Europe, yet heating consumption is likely to stay historically low. And ARA faces weaker French buying after imports to the 1.1mn t/yr Norgal terminal restarted in October.

But a spot-heavy approach brings risk that could boost premiums for buyers. ARA terminal suppliers are likely to follow downstream clients by limiting term imports, while spot US product could tighten as competition from China increases. The threat of closures has eased, but Europe's ageing refineries remain prone to outages. And the EU ban on Russian pure butane fractions under the bloc's 19th sanctions package, effective from 26 January, will remove more than 32,000 t/month of supply, which will have to be replaced partly by propane for autogas use.