Foreword

Commodity markets enter 2026 at a crossroads. Policy shifts, geopolitics and technology are converging to reshape pricing, flows and risk. Carbon costs are moving from the margins to the mainstream of trade, biofuels are poised for another step-change in Europe, and sulphur’s revaluation is rippling through fertilizer economics. Critical minerals remain a strategic pinch‑point, even as crude balances loosen and LNG becomes more pivotal to Europe’s winter resilience. Meanwhile, coal faces the push‑and‑pull of decarbonisation versus surging baseload demand from AI data centres, agriculture weighs a pivot toward oilseeds, and shipping and LPG markets recalibrate around new routes, capacity and weather risks.

This blog distils the signals that matter across these interconnected markets — what to watch, why it’s moving, and how it could affect procurement, hedging and strategy. Our aim is simple: to offer a sneak preview of the key themes, clarify the connections, and highlight the risks and opportunities so you can navigate volatility with confidence.

Read on for a concise, cross‑market briefing on the forces likely to define the year ahead—and the questions every commodities decision‑maker should be asking now.

CBAM Unleashed: Europe’s Carbon Clampdown Reshapes Global Trade

Europe is ratcheting up efforts to cut CARBON EMISSIONS. The effects of the EU’s Carbon Border Adjustment Mechanism (CBAM) are difficult to predict. It could drive up import costs for everything from steel to fertilizers. But a lot of smart money is on CBAM forcing a margin reduction for non-European producers competing with EU commodities that already carry a carbon tax. Uncertainty about how the mechanism will be implemented could also starkly affect the volume of imports in the first six months of 2026.

.png?rev=b4fec10758844d7cb8075cdb061c21b8&hash=829600F1AD996F39D78015DA2F1C8638)

Biofuels Boom: Europe’s Renewable Revolution Accelerates

BIOFUELS markets could be disrupted by the uneven application of new legislation by different European countries — the EU’s new RED III renewable energy directive was supposed to go live from 1 Jan, but member governments, including in Europe’s biggest biofuels markets, Germany and the Netherlands, were still finalising legislation in the closing weeks of 2025. Despite differing degrees of progress across EU member states, Argus expects European biofuel demand in road transportation to jump by 8% next year, driven mostly by hydrotreated vegetable oil (HVO).

Sulphur Shock: EVs and Sanctions Ignite Fertilizer Price Surge

The SULPHUR market is sounding alarm bells. Long regarded as a low-volatility oil and gas refining by-product feeding into the phosphate fertilizer market, sulphur has attained new importance because of its use in the electric vehicle (EV) battery sector — for nickel processing and LFP (lithium iron phosphate) production. Coupled with a Russian ban on sulphur exports while Moscow struggles to fix its damaged refineries, this new dynamic has pushed up Argus sulphur prices from their normal $80-180/t fob Middle East range to close to $500/t. Given its importance in fertilizers, that has serious implications for farmers around the world.

.png?rev=570ea7aa6f4d4333b9e732b47bd6802f&hash=C493909E0BD1B1B46A9A60FCB063DDD6)

.png?h=203&w=311&rev=570ea7aa6f4d4333b9e732b47bd6802f&hash=7CF995C27811ADB146003E214838923D)

Critical Minerals Crunch: Geopolitics and China Keep Markets on Edge

Geopolitics, trade wars, tariffs and sanctions will continue to dominate METALS. Critical minerals and rare earths dominated the headlines for much of 2025. Despite confident noises from Washington and now Europe, there are only tentative signs of any easing of China’s export controls on rare earth metals. And despite greater government support for critical mineral projects, the west’s dependence on Chinese supply is not going to disappear any time soon, given the lead time involved in such complex operations. The technology and military sectors also remain in a bind, courtesy of Beijing’s restrictions on exports of electronics metals such as germanium, prices for which have more than tripled to around $6,000/kg since controls were introduced in 2023.

Oil Glut or Group Harmony? Opec+ Faces a Balancing Act

In CRUDE OIL, the debate is not whether there will be a crude supply surplus in 2026, but how big it will be — Argus’ own estimates point to something in the order of 1.5mn b/d. This has raised questions over whether the Opec+ group of producers, led by Saudi Arabia and Russia, can press ahead with regular output increases as it seeks to unwind some 1.65mn b/d of output cuts. The group has already agreed to pause monthly increases in the first quarter — a tacit acknowledgement of those oversupply concerns. But unless crude prices collapse to the mid-$50s/bl, Opec+ may be tempted to start opening the taps again from the second quarter, prioritising internal group harmony over propping up prices.

Storage Squeeze: Europe’s Gas Safety Net Put to the Test

The flexibility challenge facing European NATURAL GAS and global liquefied natural gas (LNG) markets may shift gear in 2026, if we see closures of some underground gas storage sites in Germany. Argus forecasts that shuttering the two German sites most at risk of closure would reduce Europe's supply buffer by the equivalent of nearly 60 LNG cargoes per year and make the continent even more reliant on LNG during winter. Europe's gas market has been transformed since 2022 — LNG shipments have increased by nearly two-thirds and now total close to 120mn t/yr, having replaced most Russian pipeline supply. Nevertheless, in 2026, one or two large gas storage sites may close, because the difference between the price of gas in the summer and winter — how traders make money from using storage — is shrinking. If this happens, it would increase price volatility and raise the risk of price spikes, particularly in late-winter periods. LNG should be able to fill the supply gap, but it is slower to respond to price signals, and leaves Europe potentially needing to fend off competition from Asia to secure volumes.

Coal’s Crossroads: Sanctions, AI, and the Battle for Base-Load Power

Thermal COAL markets will be buffeted by the Ukraine conflict and pressure from global decarbonisation efforts. Any peace deal that eases sanctions on Russia could flood the market with cheap, high-quality Russian coal. This will create immense pressure on export prices in competing nations such as Australia and Indonesia, while also offering cheap base-load energy for the world’s two biggest importers, China and India, and growing demand hubs in southeast Asia. Meanwhile, the pace of nuclear plant restarts in Japan and elsewhere in Asia, along with renewables growth, is encouraging more power generators to switch away from coal. That said, the thirst for power created by the expansion of AI data centres is likely to provide support and keep overall production and trade volumes hovering around 2024’s record highs, when trade hit 1.1bn t and production reached 7.8bn t. A key question is whether the US coal renaissance will gather even more momentum, now that Henry Hub gas prices are back above $5/mn Btu and power demand is set to surge.

China’s Grain Gambit: The Wildcard in Global Food Markets

In AGRICULTURE, China’s purchasing decisions could be the biggest driver of global grains markets in 2026 – after two years of subdued imports, China may accelerate purchases of affordable grains and rebuild its strategic stocks, absorbing some of the current supply surplus. The biggest supply question concerns corn in the Americas. While vegetable oil markets remain supported by global biofuels policies and continue trading above pre-2020 levels, grains markets have slumped back to pre-2020 prices. The divergence may result in planted areas shifting to oilseeds at the expense of grains, particularly in the US. Meanwhile, Brazil’s booming corn-ethanol industry is set to cap the country’s export potential, after years of rising Brazilian exports meeting demand growth elsewhere. Longer-term, the switch to oilseeds areas could deepen, fuelled by eroding grains production margins because of the decoupling between grains and nitrogen prices since 2023, after more than a decade of strong correlation.

Sanctions and Supply Chains: China’s Oil Markets in Flux

CHINA OIL MARKETS: Several key crude oil flows to China – from Russia, Iran and Venezuela – remain under threat in early 2026 for a variety of geopolitical reasons. This is likely to reinforce Beijing’s desire to build up its strategic crude stocks, as a buffer against sustained disruption. China began pumping large amounts of crude into its strategic petroleum reserve (SPR) in the fourth quarter of 2025, forcing state-owned firms to cut product supply and sacrifice downstream market share to smaller independent refiners mainly based in Shandong province. That trend is likely to persist until the second half of 2026, when state-owned Sinopec opens a new crude pipeline to circumvent the Rizhao terminal, which the US placed under sanctions in October. China remains a highly oil-intensive economy, although petrochemicals have replaced motor fuels as the driver of growth – China’s Zhenhua and Saudi Aramco will open a new petrochemical-focused refinery in mid-2026 to run on mainly sour Saudi crude.

Red Sea Returns? Shipping Routes and Risks Rewritten

In FREIGHT markets, could this be the year that shipowners return en masse to the Red Sea? Containership owner Maersk has already indicated it is considering a return, and at least two containerships have recently sailed through the Suez Canal. Tankers will be slower to respond than container vessels, as the shorter journey will generate lower profits and require higher risk. Charterers could struggle to mandate a vessel to transit the Bab el-Mandeb strait, and charterers may have to cover war risk payments, which would add significantly to costs. More generally in tanker markets, a shortage of available very large crude carriers (VLCCs) will cause crude traders to seek smaller-sized vessels for their WTI shipments to Europe next year. A lack of recent VLCC deliveries from shipyards and booming demand for the 2mn bl ships to carry Americas crude to Asia will narrow any economy-of-scale savings traders get with larger vessels – something that has in fact already started to happen.

LPG Oversupply: Can Demand Catch Up with the Flood?

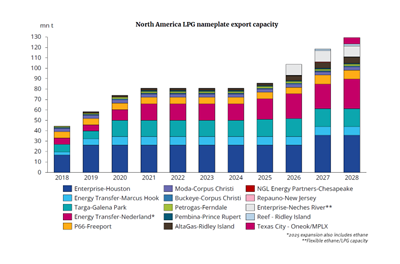

Global LPG supply looks set to continue outpacing demand. New US export capacity will add to global supplies, but will not be sufficient to offset growing domestic production and bloated inventories. Global supply absorption will hinge on a struggling petrochemical sector and China’s growing propane appetite. Pressure on prices will improve margins for Chinese propane dehydrogenation plants and for petrochemical customers more generally – propane and butane are likely to trade at significant discounts to naphtha throughout the year, making them attractive for ethylene production. But propylene oversupply, low cracker run rates, sector rationalisation and retrofits to ethane will limit demand growth. Any easing of US-China trade tensions will lift bilateral LPG flows, but China’s 10pc tariff and competition from rising Mideast Gulf supplies will continue to alter trading patterns. And then there’s the weather – forecasts highlight the potential for a colder than usual northern hemisphere winter, which could trigger brief heating demand spikes and supply shocks akin to those seen in 2021.

Chemicals in the Crossfire: Rates, Rebuilding, and Volatility Ahead

For PETROCHEMICAL markets, the two things to keep an eye on are US interest rates, and Ukraine. If the Federal Reserve keeps cutting interest rate cuts, this could revitalize a weak domestic homebuilding sector and increase demand for chemicals. Set against this is the threat of persistently weak consumer sentiment and rising unemployment, which could deter homebuilding demand even if borrowing costs for new homes fall. Any resolution of the conflict in Ukraine would also boost construction demand as the country rebuilds. But that could present a test for Europe, given the region’s recent focus on rationalisation. Price volatility could follow if increasing demand collides with Europe’s reduced production capacity.

Argus Market Highlights

These free email alerts keep you ahead of the rapidly changing energy and commodity markets with the latest news, market commentary, analytical insight, special features and key pricing indications from Argus, sent direct to your inbox.

Sign-up