The company is focused on operating a balanced portfolio to mitigate geopolitical risk and ensure production growth

Total has led the majors on upstream cost-cutting through the oil price downturn, and now aims to lead the group on production growth over the next five years. Argus recently interviewed the company's president for exploration and production (E&P), Arnaud Breuillac, in Paris. Edited highlights follow:

Where are Total's core upstream regions?

Our core regions are the North Sea, Africa and the Middle East. And then there is LNG and the deep offshore, with a particular focus on two regions — Russia for LNG and gas, and Brazil for the deep offshore. These five regions span most of the world. In terms of strategy, we are trying to be as focused as possible.

What is Total's upstream strategy for the Middle East and Africa?

In the Middle East, we are relatively diversified and balanced in terms of the countries in which we are present. First of all, we have a strong presence in Qatar. The Adco and Adma concession renewals made us the leading company in Abu Dhabi, with better contract terms and conditions than in the past. We also have a presence in Iraq that we have always said we would like to grow, but it all depends on how things go. We are keeping a close eye on how the situation develops. It might take a bit of time to see new frameworks appear, but we believe it is worthwhile.

In Iran, we are waiting for the 12 May deadline to see what is going to happen. If the US government does not renew the sanctions waiver, we will seek a specific waiver for South Pars phase 11, which is what we did for South Pars 2 and 3.

In addition to this good spread in the Middle East, we have built strong positions in north Africa, especially in Libya and Algeria. Despite the political uncertainty in Libya, its recent production track record shows that the different factions can agree on how to ensure stable output. The set-up in Algeria is very different, with much more stability. Our extensive portfolio there includes long-cycle assets with significant potential.

In Africa, we are the number one in both the upstream and the downstream. It is one of our strongholds. And our position is not focused on only one country. We have an equally significant presence in Nigeria and Angola, where we have large operations that make it possible to achieve considerable economies of scale. In the past few years, we have also heavily invested in Congo [Brazzaville], where our Moho Nord project started up last year.

Our next move is in east Africa, with the Tilenga project in Uganda — we intend to make a final investment decision [FID] before the end of this year. In terms of exploration, we have acquired extensive acreage in some prospective areas in Mauritania, Senegal, Angola and Namibia. We are also going to resume drilling in South Africa, at a high-potential prospect. The idea is to grow Total's presence in the E&P segment in all of these countries.

What about northwest Europe?

We still consider it an area with exploration and development potential. In the medium term, it is important to be able to manage our cost base well. And in terms of synergies, our acquisition of [Denmark's] Maersk Oil was an ideal solution, especially in the UK North Sea. At the same time, we are continuing to optimise our portfolio, particularly in Norway. We have a non-operating stake in the Johan Sverdrup field from the Maersk portfolio, and we have divested other assets in the country to [state-controlled] Statoil. Norway still accounts for a large share of our portfolio, and we are trying to be efficient as a non-operator.

Denmark is home to big Maersk operations, where we can apply our cost reduction methods. When you add in the Netherlands, we are the number-two operator in the North Sea. We are also continuing exploration in Norway and the UK, because we still believe in their potential.

Total is present in Russia, mostly through its partnership with and interest in independent producer Novatek. What is the strategy there?

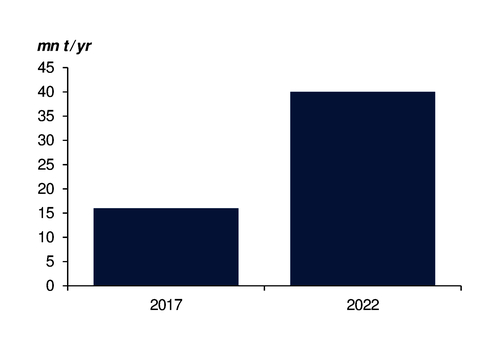

Novatek has been a rising star in the Russian industry in the past few years. And it has really put the country on the LNG map, with the addition of the [17.5mn t/yr] Yamal LNG project.

Train 1 has been producing above its design capacity since it started up late last year. First gas came in early winter and we were able to show that the ice-class carriers — the one completely new element of the project — proved very effective, performing above design objectives. We are gearing up to start train 2 around October. If you look at the time it took to start train 1, we are confident about LNG production from train 2 before the end of this year. LNG really is a game-changer for Russia, opening up a new province with the shipping route through the Arctic.

And what about the deep offshore, another pillar of Total's strategy?

We have long had deep offshore assets in west Africa. But we are now expanding into Brazil, which has very high potential in deep offshore developments. We have forged a strategic partnership and alliance with [state-controlled] Petrobras, allowing us to enter into very attractive pre-salt fields, in addition to the giant Libra complex. The Iara field that we have added is in the development stage, with its first floating production unit scheduled to start up this year.

We have also become the operator of the Lapa field, which makes us the first international oil company to be an operator in Brazil's pre-salt. It is not a large field, 50,000 b/d, but we will launch phase-2 development before the end of this year to maintain this plateau. And we are working with Petrobras, trying to see how we can develop new technology — for much more efficient tie-backs, for example. This technology will also be applied in deep water offshore Nigeria and Angola, so it is a very good strategic fit for us.

We are growing in the US Gulf of Mexico, mainly through our partnership with Chevron. We will also apply the same know-how and expertise there that we already have in the African deep offshore. The US Gulf is increasingly becoming a playing field for large companies, partly because of the technology you need to put in place. We believe Total... is well positioned to be active in this region.

We have been successful in [Mexican] licensing rounds, securing six blocks, including three that we operate. We will drill the first well in the Perdido [fold belt] in the north later this year. We are very pleased with what we have. There will be new rounds, and we are still interested. We are pleased because we were able to partner [state-owned] Pemex in the latest round — we will explore two blocks together. When you look at a map of the Gulf of Mexico and compare the number of wells drilled in US and Mexican waters, there has to be potential, because geology does not recognise borders. Mexico is an important country for us. We already have quite a large presence in the downstream. We are willing to grow our upstream business there.

How are Total's upstream operations different from those of its peers?

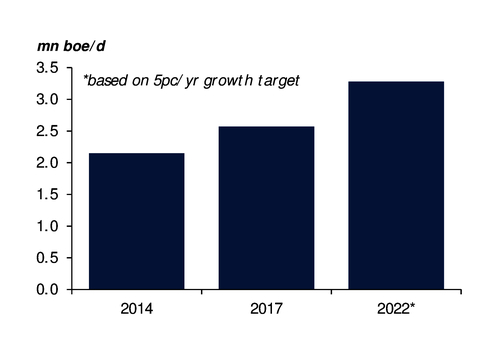

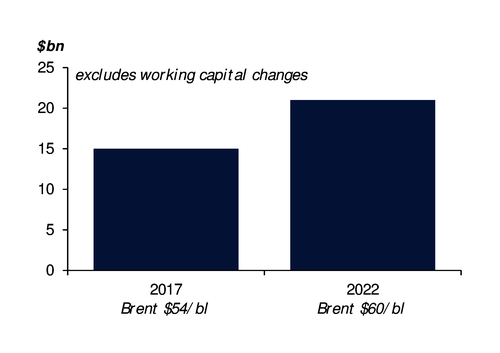

We have been leading the pack in the past two years in terms of operational efficiency and operating costs, and have been very good at growing production. We believe our pipeline of projects will give us 5pc/yr growth to 2022. All of these projects are there to be seen, and we are making FID after FID.

As far as costs go, improvement is an ongoing process. We are very competitive at around $5.50/bl of oil equivalent, and we want to maintain this for the next five years, while production continues to grow. We put together a very effective cost reduction programme for 2015-17. It generated cumulative cost savings of $2.3bn. We are now embarking on a new plan for 2018-20, with the same approach. We call them bottom-up action plans, where people come up with ideas, which are then consolidated and shared among all affiliates.

We are also trying — quite successfully — to convince our partners in joint operating companies, like those in the Middle East, to use our best practices and methodology, as their production costs contribute to our unit costs. It is not rocket science. It is a lot of very small things. It is a mindset more than anything else — people must be aware of their costs and think twice before they spend money. When they have to spend, they do it in the most efficient way.

How significant can digitisation be in driving cost reductions?

The positive impact that digital technology will have on our efficiency has been completely underestimated. We are already achieving impressive results using only 1pc of the data gathered in E&P operations so far. The potential offered through using more and better data is huge. Combing through data still takes a third of our field experts' time. But digital tech lets you address both issues, which gives you a clearer idea of how huge that potential is. I think it will be achieved much faster than we think. And it will help make our industry more competitive, with the objective being to produce affordable energy at low cost.

Another area where digital tech could do a lot is geoscience. You have to spend a few hundred thousand dollars on computing, but you save millions of dollars, and sometime tens of millions, on wells. This is because you will drill the right wells in the right place, and you can optimise your development. The potential impact of digital tech for geoscience applications on our industry's efficiency is completely underestimated today.

We have just launched a partnership with [technology giant] Google to develop artificial intelligence (AI) solutions applied to sub-surface data analytics for oil and gas E&P. Our goal is to develop an AI personal assistant for our geoscience engineers in the next few years that will save time previously spent on data research, allowing them to focus on more value-added tasks.

Digital technologies are making their presence felt — for example, we now have tools to monitor more than 200 of our large rotating machines in real time. They keep track of a range of parameters. As soon as these move, the data go back to our technical centre and our experts can anticipate and avoid failures that would result in lost production. For example, a turbine failure could potentially lead to the replacement of the complete turbine. We are talking about more than $1mn in costs. If you can catch things before they fail, you save a lot of money. At the same time, we have been able to extend the life of machines. When we can see that their operating conditions are safe, we can postpone some routine maintenance, again resulting in significant savings.

How much of Total's cost reductions are under its direct control?

It very much depends on the type of service or product you are looking at. Where you had significant cost reductions, you can expect that there will be an inflation component when activities pick up again. We have not seen very many big FIDs, and when we meet with our suppliers and contractors, they are very eager to get new work. The industry is at far from full activity. So we continue to see further cost reductions for some services, and have not seen any signs that they are going to go up again.

There is also a part of the cost reduction process that can be considered irreversible — we have learnt to be sustainably more efficient in working with our contractors. We bring them in right from the design process. This improves alignment in terms of contracting strategy, so we can be sure that what is good for us is also good for them, and vice versa. That was not always the case before — and is still not always possible.

All the work accomplished on revising our project specifications and our design and maintenance philosophy will stay. Industry-wide, there is a lot of talk about standardisation and shared logistics, and things are really starting to move.

How have the global energy transition and the issue of climate change influenced Total's upstream strategy?

We want to be positioned on what we call low-cost oil projects, which are very competitive. We believe these will be the last barrels to be produced, and will offer a good margin. This is very much in line with the strategy that we have deployed in the Middle East in the past two years.

We also believe gas consumption, and therefore gas production, will speed up. We think our gas portfolio will grow further in the future. This, by the way, is why we are integrating along the gas value chain, the same way we did for oil. And within gas, there is LNG — one of our strategic areas of growth. We will have significant future LNG supply from the [5.4mn t/yr] Papua LNG plant and South Pars phase 11. And we have many other gas projects in our sights.

Looking at our E&P business in general, we are focusing on projects that offer a good return. In other words, low-cost projects, or projects with the potential to improve the cost base through synergies. Proactive management of our portfolio and its continuous optimisation are very important, because we believe some of our assets are performing to target, and some are not. So we either fix them or divest them. And when we divest, we get the opportunity to buy other assets. This is ongoing work that will continue. That it is how we will stay more competitive than our peers.

To what extent is Total's expansion in the North Sea and the US Gulf of Mexico driven by a desire to reduce geopolitical risks in its portfolio?

Total's approach is to have an evenly balanced portfolio, between oil and gas and different types of project. Onshore, offshore, deep offshore, LNG and growing our expertise in unconventional resources through our very promising acreage that we operate in Argentina's Vaca Muerta and the US Barnett shale. We also believe geographical balance is important, even though we should not spread ourselves too thin, as I said.

When we acquired Maersk, we said it was 80pc in OECD countries. This is because it was the North Sea and the US, with the Chevron-operated Jack field, which was another way to consolidate our partnership with Chevron in the US Gulf of Mexico. But it boils down not to OECD or non-OECD, but an even spread. We try not to be over-present in one country, because it is not good for Total, and not necessarily good for the country when there is a dominant player there.

We believe the best way for a company like ours to manage various uncertainties is to have a balanced portfolio — not too scattered and not too focused on any one country or asset. It is important to have a large enough portfolio, which we have today. But it also has to be balanced.

For more intelligent opinion and analysis, request a free trial of Petroleum Argus

| Planned FIDs in 2017-18 | ||

| Project | Country | Stake (%) |

| Apsheron 1* | Azerbaijan | 40† |

| Vaca Muerta* | Argentina | 41† |

| Halfaya 3* | Iraq | 22.5 |

| Libra 1* | Brazil | 20 |

| Tyra future* | Denmark | 31.2† |

| South Pars 11 | Iran | 50.1† |

| Zinia 2 | Angola | 40† |

| Kashagan 1 expansion | Kazakhstan | 16.8 |

| Lake Albert | Uganda | 44.1† |

| Ikike | Nigeria | 40† |

| Libra 2 | Brazil | 20 |

| Fenix | Argentina | 37.5† |

| Johan Sverdrup 2 | Norway | 8.44 |

| *FID made †operated | ||