Australia has declared a La Nina event in the tropical Pacific, which combined with the negative Indian Ocean Dipole (IOD) and positive Southern Annular Mode (SAM) indicates above average rainfall for the rest of 2022.

This is the third La Nina weather trend in a row, increasing the chances of above average rainfall across already saturated ground and filled water storage in east and north Australia. Models indicate that this La Nina event may peak in September-November and return to neutral conditions in early 2023, the Australian Bureau of Meteorology (BoM) said. The 2021-2022 La Nina ended in June.

Heavy rainfall, storms, flooding and saturated ground in New South Wales (NSW) and Queensland has disrupted coal mining, railing and shipping, as well as coal-bed methane (CBM) development to supply gas to export LNG and domestic markets over the past two years. It also delayed the harvest in parts of these states last year, and caused large volumes of wheat and barley to be downgraded to feed grains from milling wheat and malting barley.

The presence of the IOD, which has been in place since June, will raise the chances of increased rainfall in eastern Australian from the La Nina during October-November.

The chances of increased rainfall in eastern Australia from the La Nina will rise in October-November by the presence of the IOD, which has been in place since June. The positive SAM will also increase the chances of heavy rain in eastern New South Wales (NSW) and far eastern Victoria, the BoM said.

A La Nina event is associated with lower or average rainfall in Western Australia state, where the majority of the nation's iron ore and export wheat are produced.

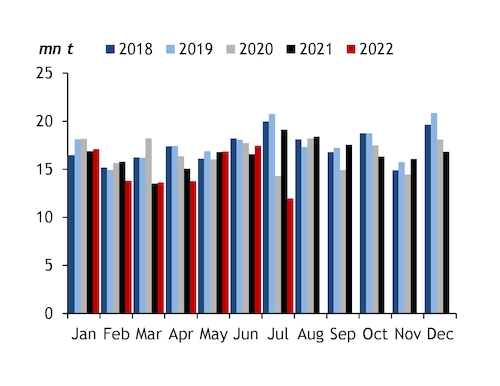

Australia's coal exports were down by 8pc in the July 2021-June 2022 fiscal year compared with 2019-2020, which was the last year that was not a La Nina year, and fell further in July. The drop was despite record-high thermal and metallurgical coal prices during 2021-2022, which would usually result in increased supplies if mining firms were not struggling with the effects of flooding and waterlogged pits. Some mining firms have built more water storage facilities over the past year, although they are starting from a position of more water on site than a year earlier.

A La Nina event is also often associated with increased likelihood of tropical cyclones making landfall in north Australia, with cyclones often closing oil and gas infrastructure, iron ore and coal export facilities, along with major rail and road corridors.