Overview

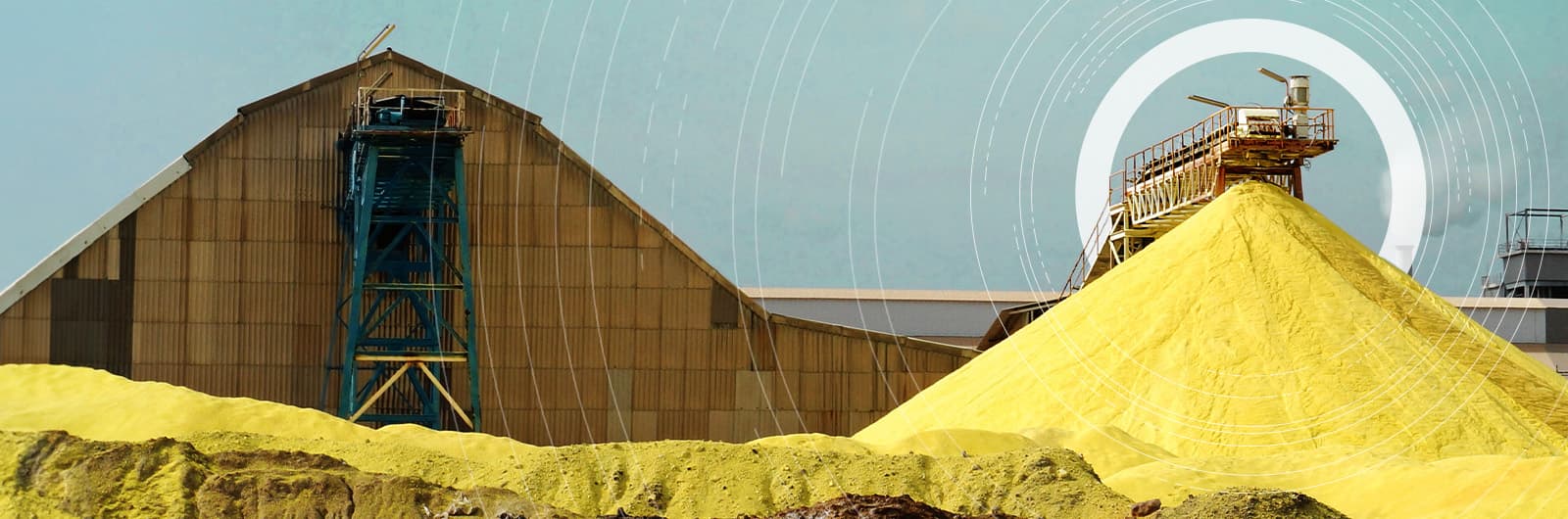

The global sulphur market has gone through fundamental changes in buying patterns, trade routes and pricing over the past few years. Fixed price contracts and formula-based indexation have become the dominant ways in which supplies are bought and sold around the world, which makes accurate price assessments and detailed analysis key to any sulphur market participants.

The global sulphuric acid industry has seen structural change in recent years and new capacities will continue to challenge the balance in the years to come. While demand will be driven by fertilizers — predominantly the increased production of phosphate and ammonium sulphates — the market will continue to be exposed to short-term supply shocks, especially from the metals sector.

Rising demand for battery materials such as nickel and cobalt (due to growing electric vehicle production) will in turn bolster demand for sulphur and sulphuric acid, increase competition for supply and impact pricing.

Our extensive market coverage includes formed sulphur (both granular and prilled), crushed lump sulphur, molten/liquid sulphur and sulphuric acid. Argus has decades of experience covering these markets, and incorporate our multi-commodity market expertise in key areas including phosphates and metals to provide the full market narrative.

Argus support market participants with:

- Price assessments (daily and weekly for sulphur, weekly for sulphuric acid), proprietary data and market commentary assessments

- Short and medium to long-term forecasting, modelling and analysis of sulphur and sulphuric acid prices, supply, demand, trade and projects

- Bespoke consulting project support

Latest sulphur and sulphuric acid news

Browse the latest market moving news on the global sulphur and sulphuric acid industry.

Landslide hits Indonesian nickel tailings site

Landslide hits Indonesian nickel tailings site

Singapore, 19 February (Argus) — A landslide on 18 February triggered by heavy rains has caused the collapse of a tailings facility at the Indonesia Morowali Industrial Park (IMIP) on the eastern side of Sulawesi. The facility is operated by battery materials producer QMB New Energy Materials, many market participants said, although the company has denied ownership. The facility serves as a site for tailings disposal generated from nickel production. Details remain limited, but several pieces of heavy equipment and an operator have been buried and operations are suspended at this stage, according to market participants. This may weigh on nickel production and sulphur and acid demand. Tailings disposal challenges have persisted since last year. QMB New Energy Materials was previously forced to cut operating rates in November 2025 because of a tailings capacity issue before resuming full operations in December after securing a new disposal site. It remains unclear whether the landslide occurred at this new location. The high-pressure acid leaching (HPAL) process generates an estimated 1.4–1.6t of tailings waste for every 1t of nickel produced. By Deon Ngee Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Indonesia’s RKAB cuts threaten sulphur demand

Indonesia’s RKAB cuts threaten sulphur demand

Singapore, 12 February (Argus) — Proposed cuts to Indonesia's nickel production quotas will potentially weigh on operating rates at high-pressure acid leaching (HPAL) plants and raise production costs. Indonesia's energy and mineral resources ministry (ESDM) is expected by market participants to reduce this year's nickel ore work plans and budgets (RKAB) quotas to 250mn–260mn t, down sharply from 370mn t in 2025, which has caused consternation in the market since January. Concerns intensified after French miner Eramet confirmed on 11 February that its subsidiary Weda Bay Nickel (WBN) — the world's largest nickel mine — was allocated just 12mn wet metric tonnes (wmt) of RKAB for 2026, a steep drop from 42mn wmt last year. The announcement triggered a prompt spike in benchmark nickel prices, with the three-month London Metal Exchange (LME) contract settling at $17,940/t on 11 February, up by 4.4pc on the day. Sulphur and sulphuric acid are crucial feedstocks for producing nickel matte and mixed hydroxide precipitate (MHP) via the RKEF and HPAL processes respectively, with sulphuric acid in Indonesia typically generated by burning sulphur in on-site plants. The tightened RKAB quotas may lead to two potential outcomes. Producers may need to increase nickel ore imports from the Philippines or New Caledonia to maintain feedstock supply, raising production costs. But export availability from both sources remains constrained, with the Philippines already channelling most ore sales to China, while New Caledonia continues to face operational challenges. Meanwhile, surging sulphur prices have already eroded margins. Argus assessed granular sulphur cfr Indonesia at $542.50/t on a midpoint basis on 5 February, a rise of $367/t, or 196pc, from 3 January 2025. The sharp increase has been driven in part by robust demand from Indonesia's rapidly expanding nickel industry, which imported 5.35mn t of sulphur in 2025, 48pc higher than a year earlier. The rise in sulphur prices combined with limited ore supply may push margins for downstream products such as MHP into negatives. The second possible outcome is curtailed operating rates. Battery metals producers were mostly running at above nameplate capacities at their HPAL units through most of 2025, market sources said. A reduction in utilisation would directly impact demand for both sulphur and sulphuric acid. But this remains unlikely, given that HPAL facilities are typically required to operate at high rates for cost-efficiency. Higher production costs or lower capacity utilisation rates may lead to weaker demand or delays in new Indonesian projects. The latest RKAB quota reductions are expected to primarily affect operations in the Indonesia Weda Bay Industrial Park (IWIP) in North Maluku, the main recipient of WBN nickel ore. IWIP hosts Chinese producer Huafei, which requires around 1.67mn t/yr of sulphur at capacity, and Indonesian firm Blue Sparking, which came on line last month and requires 666,667 t/yr of sulphur at capacity. Stainless steel producer Tsingshan's Guangqing project, slated for commissioning in 2027 and expected to add another 666,667 t/yr of sulphur demand, may also face delays. By Deon Ngee Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Abu Dhabi's Adnoc raises Feb sulphur price by $10/t

Abu Dhabi's Adnoc raises Feb sulphur price by $10/t

London, 5 February (Argus) — Abu Dhabi's state-owned Adnoc has set its February sulphur official selling price (OSP) for the Indian subcontinent at $530/t fob Ruwais, up by $10/t from its January OSP. Adnoc's February OSP implies a delivered price of $546-548/t cfr India, with the freight cost for a 40,000-45,000t shipment to the east-coast of India last assessed at $16-18/t on 29 January. By Maria Mosquera Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Kuwait's KPC raises Feb sulphur price by $4/t

Kuwait's KPC raises Feb sulphur price by $4/t

London, 2 February (Argus) — Kuwait's state-owned sulphur producer KPC has set its February Kuwait Sulphur Price (KSP) at $520/t fob Kuwait, up by $4/t from the January KSP. The February KSP implies a delivered price to China of $542-547/t cfr at current freight rates, which were assessed on 29 January at $22-24/t to south China and at $26-27/t to Chinese river ports for a 30,000-35,000t shipment. By Maria Mosquera Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Argus Fertilizer Market Highlights

The complimentary Argus Fertilizer Market Highlights package includes:

• Bi-weekly Fertilizer Newsletter

• Monthly Market Update Video

• Bi-monthly Fertilizer Focus Magazine

Spotlight content

Browse the latest thought leadership produced by our global team of experts.